All The Asian Banker Articles

Singapore’s central bank has launched a platform that allows financial institutions to exchange customer information and flag suspicious activities leading…

Raja Teh Maimunah, CEO of AEON Bank, provides insights into Malaysia's first Shariah-compliant digital bank, which is poised to transform banking. With…

China’s economy grew faster than expected at the start of the year but it remains to be seen if it signals a solid recovery trend as the crisis-hit property…

Banking leaders convened at a roundtable in Kuala Lumpur recently, with panellists pointing to agility and innovation as transformational drivers, emphasising…

Critiqued as a necessary but flawed response to societal issues, philanthropy stands as a mediator of wealth and persistent inequality, prompting a need…

As sustainable finance grows, global governments and stakeholders employ AI and regulations to tackle greenwashing and greenhushing, promoting transparent,…

Surging past $1.3 trillion, the cryptocurrency marks a significant milestone, with some enthusiasts predicting a potential $56 trillion cap by 2034

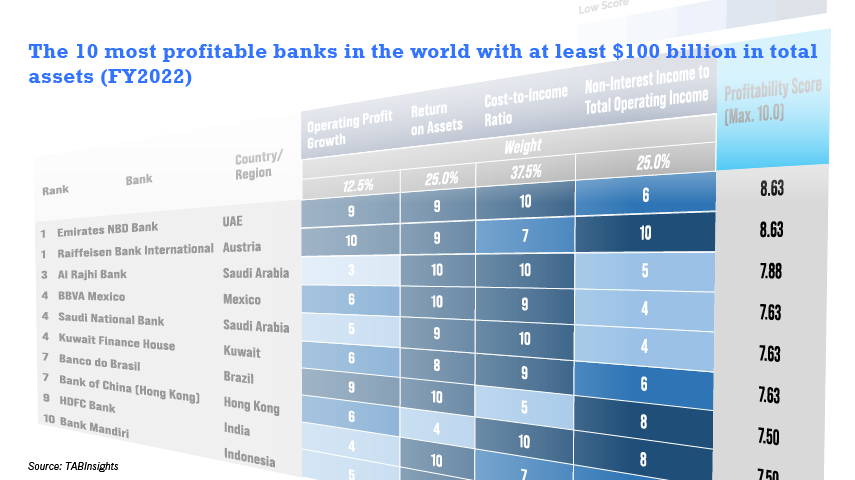

The world’s top 10 most profitable banks with assets over $100 billion include four from the Middle East, three from Asia, two from the Americas, and one…

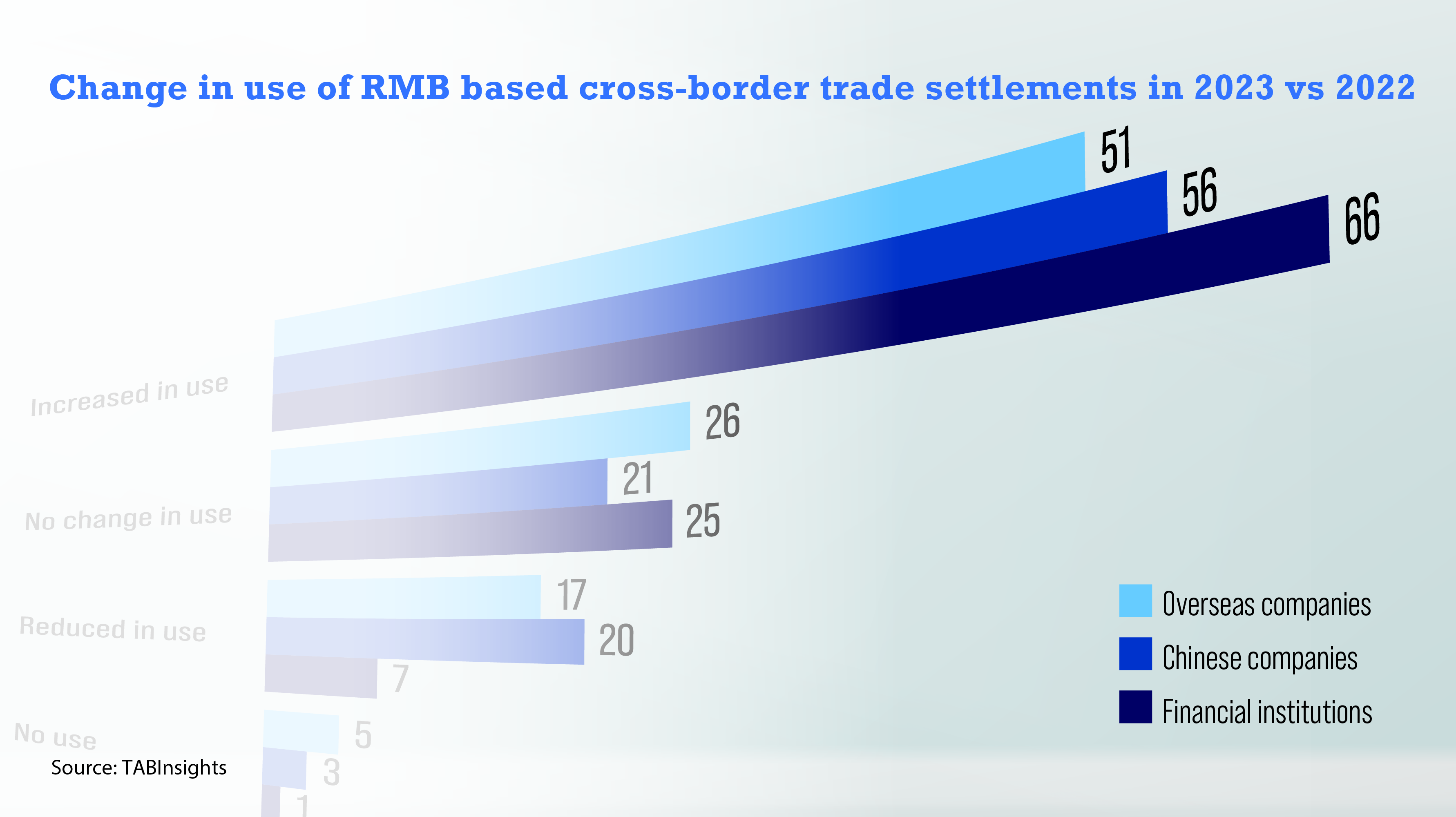

The global use of Renminbi is influenced by geopolitics, macroeconomic conditions, infrastructure, and technology

The popularity of Bank Central Asia reflects a trend of traditional banks embracing digital innovation to meet customer preferences

James Cheo of HSBC Global Private Banking highlights the growth in ASEAN and India’s investment landscape, emphasising portfolio diversification and the…

Nubank has reported its first full-year profitability since its launch in 2014. Nearing 100 million customers, the bank has set new benchmarks in revenue

Alipay retains its top spot in this year’s ranking, while Apple Pay climbs higher with its expanded financial services ecosystem

JPMorgan Chase, China Construction Bank, and Emirates NBD claimed leading spots in this year’s ranking, with JPMorgan Chase standing out in retail financial…

Bank of the Philippine Islands is expanding its reach and deepening retail loan market impact by enhancing digital and physical networks, embracing open…

Generative AI revolutionises banking operations, regulatory frameworks adapt to innovation, and digital banks expand in global markets, marking significant…

TABInsights’ global benchmarks in retail and digital banks, and financial platforms, signal a significant shift towards digital transformations

A prominent player in Southeast Asia’s digital finance sector, the group saw significant growth in 2023, cutting losses by 29% despite a challenging economic…

Surveyed institutions continue to adopt RMB in cross-border trade, driven by cost benefits and foreign exchange risk management

Industry leaders converged in Seoul to explore the transformative potential of emerging technologies like AI and blockchain, and highlighted the imperative…

Philippine digital banks saw rapid growth in 2023 alongside mounting concerns over credit quality as gross NPL ratios soared

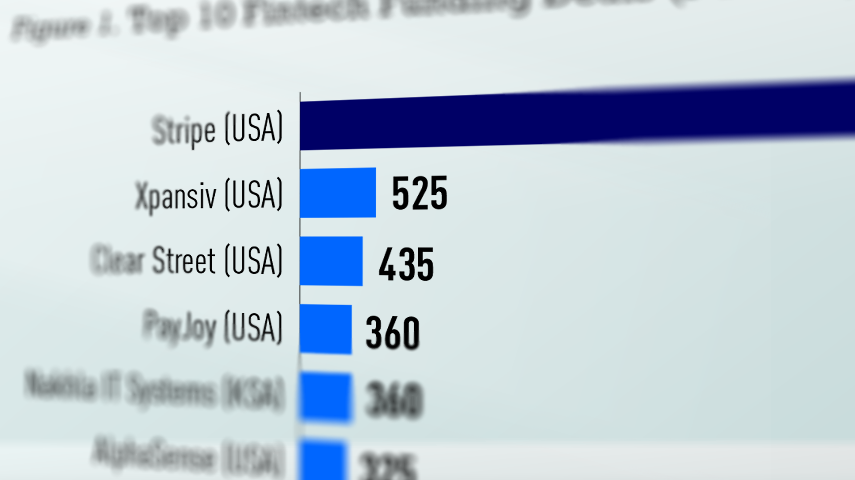

Fintech funding dropped 42% in 2023 due to economic challenges, yet top firms like Stripe and Investree saw significant investments, demonstrating resilience…

TAB Global’s annual Retail Finance Leader of the Year in Asia Pacific award recognises outstanding contributions to sustainable banking and institutional…

Under chairman Cho Yong-byoung, the Korea Federation of Banks will focus on enhancing industry ethics and innovation, aiming to combat misrepresentation…