AI Listing

Promising companies in generative AI for financial services

The field of generative artificial intelligence (AI) in finance is nascent and dynamic. Given the high levels of interest around AI, financial services companies, fintechs and others are keen to adopt AI technologies into their products and services.

Any list of promising companies in the industry must therefore distinguish ‘announcements’ and ‘intentions’ from veritably deployed products and services that are being validated by the market. This list was compiled based on research into the team and investors of each company, as well as their partners and awards, current products and services, as opposed to those announced for the future, and publicly-available customer testimonials and case studies. In and of itself, revenue-to-date was not a criterion for exclusion.

| Vision | Leader | Insights | |

|---|---|---|---|

Conversational AI platform for customer experience management for banks, using AI to understand and follow complex customer interactions, and assist customer service agents to enable improved customer experience. |

Jon Newhard |

SECTORS, Banking and finance: Front Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 60POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2015WEBSITE, https://clinc.com/INVESTORS, National Science Foundation, Insight Partners, Hyde Park Venture Partners, DFJ Growth, Drive Capital |

|

|

AI powered-platform for customer support management with faster resolution times and lower cost of resolution for each customer support ticket. Works with leading financial service companies. |

Deon Nicholas |

SECTORS, Banking and finance: Front Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 92POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2017WEBSITE, https://forethought.ai/INVESTORS, Y Combinator, Techstars, National Science Foundation, EASME, MassChallenge |

|

Conversational finance platform for customer management to engage with customers effectively, enhancing conversion rates at a lower cost of acquisition. |

Aakrit Vaish |

SECTORS, Banking and finance: Front Office

COUNTRY, IndiaTOTAL AMOUNT RAISED ($M), 7POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2013WEBSITE, https://www.haptik.ai/INVESTORS, Kalaari Capital, Times Internet, Vivek Kumar |

Develops AI-driven personalised banking solutions from real-time insights to recommendations and automated money management. Works with leading banks and financial service providers like KBC, Santander and DBS. |

David Sosna |

SECTORS, Banking and finance: Front Office

COUNTRY, IsraelTOTAL AMOUNT RAISED ($M), 192POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2010WEBSITE, https://personetics.com/INVESTORS, Sequoia Capital, Lightspeed Venture Partners, Warbug Pincus, Viola Ventures, Nyca Partners |

|

Offers feeback analysis for customer success management, using natural language reports, to analyse and present the important themes to increasing customer retention based on the urgency of the customer feedback language, customer tiers and churn risk. |

Daniel Erickson |

SECTORS, Banking and finance: Front Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 11POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2020WEBSITE, https://www.askviable.com/INVESTORS, Bossanova Investimentos, Streamlined Ventures, Craft Ventures, Javelin Venture Partners, GTMfund |

|

|

Lucinity makes it simpler for compliance professionals to navigate the complexities of financial crime (FC) prevention, delivering AI based augmented intelligence to help FC teams operate with enhanced precision and insight. Works with leading financial service providers like SEON, Experian and Neterium. |

Gudmundur Kristjansson |

SECTORS, Banking and finance: Middle Office

COUNTRY, IcelandTOTAL AMOUNT RAISED ($M), 25POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2018WEBSITE, https://lucinity.com/INVESTORS, byFounders, Karma Ventures, Keen Venture Partners, Crowberry Capital, Experian |

|

QuantPi is an explainable AI platform that allows enterprises to achieve regulatory compliance. Works with leading organisations like NVIDIA and the German Federal Government. |

Philipp Adamidis |

SECTORS, Banking and finance: Middle Office

COUNTRY, GermanyTOTAL AMOUNT RAISED ($M), 3POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2020WEBSITE, https://www.quantpi.com/INVESTORS, Capnamic Ventures, First Momentum Ventures, Mirko Novakovic, Ash Fontana |

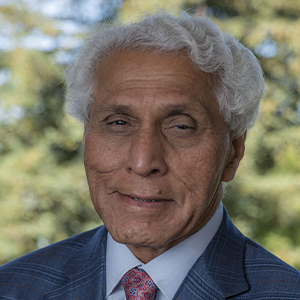

Provides AI-driven insights and automation for financial institutions for faster financial crime detection, identifying money laundering and preventing fraud. Works with leading financial service providers like HSBC, Nordics Financial and Cecabank. |

Romesh Wadhwani |

SECTORS, Banking and finance: Middle Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), NAPOST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2017WEBSITE, https://www.symphonyai.com/INVESTORS, NA |

|

|

To assist companies in making informed credit choices, ZestFinance offers an open, transparent and easy-to-use AI-driven lending solution. Zest Automated Machine Learning (ZAML) is their platform for providing explainable AI in credit and automating risk management. |

Mike de Vere |

SECTORS, Banking and finance: Middle Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 318POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2009WEBSITE, https://www.zest.ai/INVESTORS, Lightspeed Venture Partners, Insight Partners, Matrix Partners, Northgate Capital, Baidu |

Workplace search and knowledge discovery engine that allows access to information across all of an enterprise’s apps for better decision-making and operational effectiveness, particularly internal decision-making. Works with leading financial service providers like WealthSimple, Super and Upside. |

Arvind Jain |

SECTORS, Banking and finance: Back Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 155POST-MONEY VALUATION ($M), 1000YEAR ESTABLISHED, 2019WEBSITE, https://www.glean.com/INVESTORS, Sequoia Capital, Kleiner Perkins, Lightspeed Venture Partners, General Catalyst, Slack Fund |

|

|

Database management platform that lets users update, explore and visualise data collaboratively, without needing to be an expert in database operations, using natural language programming (NLP) to translate human language into structured database queries. |

Brandon Strittmatter |

SECTORS, Banking and finance: Back Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 0.5POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2022WEBSITE, https://outerbase.com/INVESTORS, Y Combinator, Surface Ventures |

|

Uses AI to match job candidates with financial roles based on cognitive and emotional traits. It is a soft-skills platform focusing on hiring and talent management using data- driven behavioral insights and AI. Works with banks and asset management companies. |

Frida Polli |

SECTORS, Banking and finance: Back Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 57POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2011WEBSITE, https://www.pymetrics.ai/INVESTORS, MassChallenge, Khosla Ventures, Salesforce Ventures, General Atlantic, BBG Ventures |

Platform for accounting and fraud detection using an AI driven accounts payable engine and integrated autonomous approval flows for financial back-office operations. |

Alexander Hagerup |

SECTORS, Banking and finance: Back Office

COUNTRY, USATOTAL AMOUNT RAISED ($M), 115POST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2017WEBSITE, https://www.vic.ai/INVESTORS, GGV Capital, ICONIQ Growth, Costanoa Ventures, Cowboy Ventures, Connectivity Venture Fund |

|

The company utilises natural launguage programmng (NLP) and Al to extract insights from millions of documents across earnings, broker research, company documents, expert calls, and more to make smarter business decisions across a company's operational domains. |

Jaakko Kokko |

SECTORS, Investment and wealth management

COUNTRY, USATOTAL AMOUNT RAISED ($M), 593POST-MONEY VALUATION ($M), 1800YEAR ESTABLISHED, 2011WEBSITE, www.alpha-sense.comINVESTORS, EASME, BlackRock, Morgan Stanley, Innovation Endeavors, Bank of America |

|

Briink is building AI infrastructure to help sustainable finance workers understand ESG, providing advice on ESG data and reporting systems. Works with leading companies like Continental, LightRock and Coller. |

Tomas van der Heijden |

SECTORS, Investment and wealth management

COUNTRY, GermanyTOTAL AMOUNT RAISED ($M), NAPOST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2021WEBSITE, https://www.briink.com/INVESTORS, Merantix |

|

|

Mistral outlines a mission to push AI forward, to serve the open community and our enterprise customers. To reach such goals, Mistral is committed to driving the AI revolution by developing open-weight models that are on par with proprietary solutions. |

Arthur Mensch |

SECTORS, Generative artificial intelligence for a variety of pan-industry applications, especially large language modelsCOUNTRY, FranceTOTAL AMOUNT RAISED ($M), $528 millionPOST-MONEY VALUATION ($M), $2 billionYEAR ESTABLISHED, 2023WEBSITE, https://mistral.aiINVESTORS, Andreessen Horowitz, Lightspeed Venture Partners |

|

An AI-powered platform that provides instant financing options for consumers. |

Max Levchin |

SECTORS, Banking and FinanceCOUNTRY, USATOTAL AMOUNT RAISED ($M), 1,421.74POST-MONEY VALUATION ($M), 2,900YEAR ESTABLISHED, 2012WEBSITE, https://www.affirm.com/INVESTORS, Spark Capital, Founders Fund, GIC, Light Speed Ventures |

|

An AI-powered platform that provides affordable financing solutions for customers. |

David Girouard |

SECTORS, Banking and FinanceCOUNTRY, USATOTAL AMOUNT RAISED ($M), 145.261POST-MONEY VALUATION ($M), 10YEAR ESTABLISHED, 2012WEBSITE, https://ir.upstart.com/INVESTORS, First Round Capital Management, LLC

|

|

Tailored for banking, excels in conversational AI tasks. Trained on real interactions, it provides fluent, coherent, and contextually relevant responses, automating customer service and enhancing efficiency in banks. |

Zor Gorelov |

SECTORS, Banking

COUNTRY, USATOTAL AMOUNT RAISED ($M), $82.3MPOST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2013WEBSITE, https://kasisto.com/INVESTORS, Oak HC/FT, Ten Coves Capital, Rho Ventures, Two Sigma Ventures, Propel Venture Partners, Partnership for New York City, Naples Technology Ventures, NCR Corp, FIS, Mastercard, Westpac, DBS Bank |

|

Designed for the banking sector as a subscription service, it swiftly deploys deep learning capabilities to boost competitiveness and efficiency. Offering functions like sentiment analysis, entity recognition, language generation, and translation, it enhances data processing and comprehension, elevating operations and customer experience. |

Rodrigo Liang |

SECTORS, Banking & Public SectorCOUNTRY, USATOTAL AMOUNT RAISED ($M), $1.13BPOST-MONEY VALUATION ($M), NAYEAR ESTABLISHED, 2017WEBSITE, https://sambanova.ai/INVESTORS, SoftBank Vision Fund 2, funds and accounts managed by BlackRock, Intel Capital, GV, Walden International, Temasek, GIC, Redline Capital, Atlantic Bridge Ventures, Celesta, and several others |