DatafilesDatafiles,

Datafiles,

Philippine digital banks saw rapid growth in 2023 alongside mounting concerns over credit quality as gross NPL ratios soared

DatafilesDatafiles,

Datafiles,

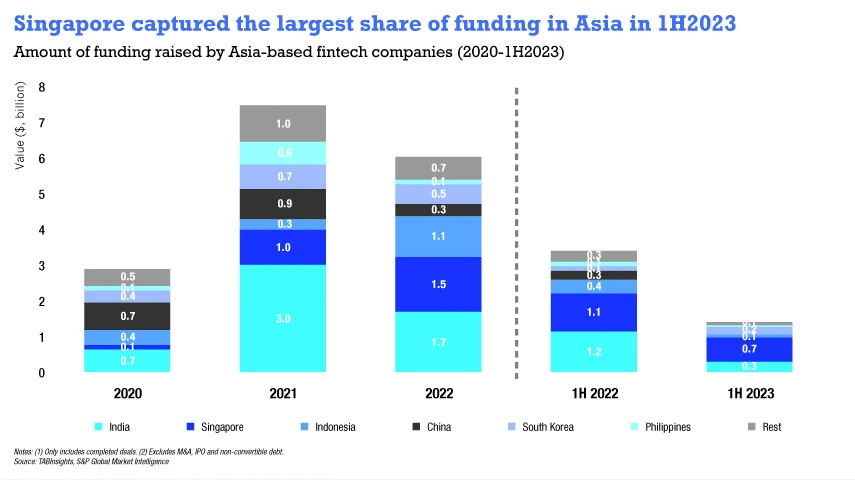

While India led in fintech funding between 2020 and 2022, Singapore outpaced India in the first half of 2023, driven by the digital lending and insurtech…

DatafilesDatafiles,

Datafiles,

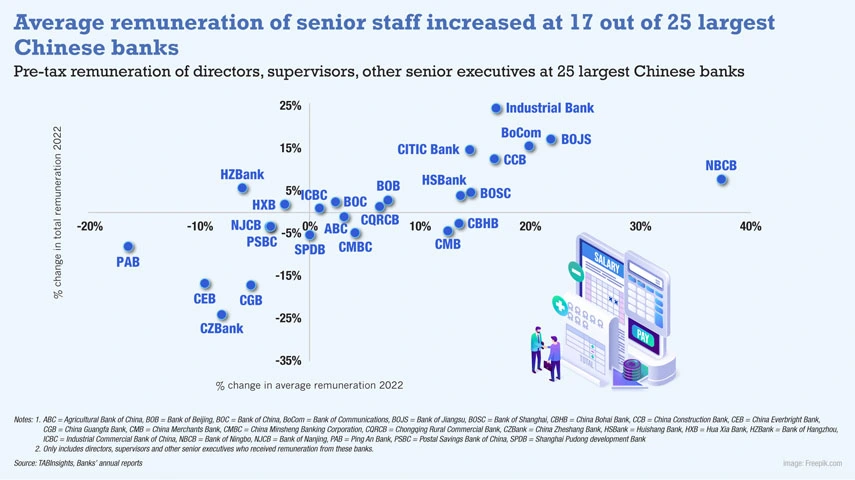

Despite efforts to cap financial sector pay, 17 out of the 25 largest commercial banks in China saw a rise in average remuneration for their directors,…

DatafilesDatafiles,

Datafiles,

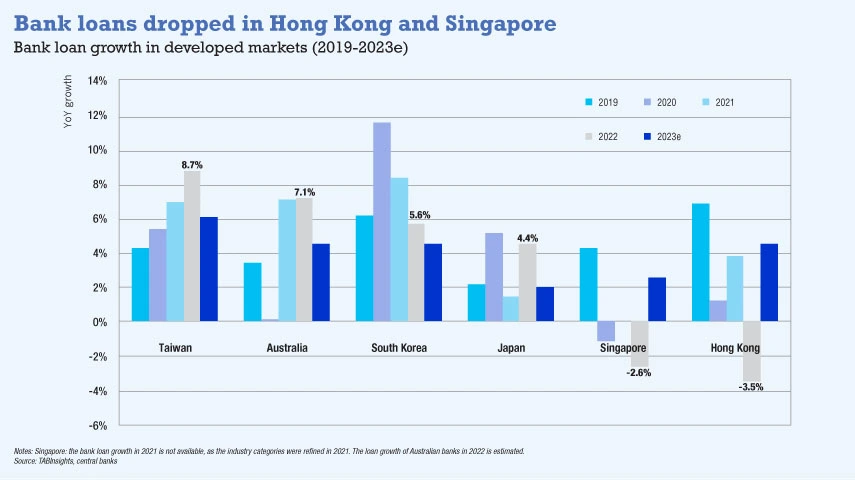

Softening bank loan growth in some markets but Asia Pacific expected to sustain momentum in 2023 with post-COVID-19 recovery in China boosting lending…

DatafilesDatafiles,

Datafiles,

The mBridge pilot has tested the issuance of over $12 million in central bank digital currencies (CBDCs) and payments of over $22 million on bridge. It…

DatafilesDatafiles,

Datafiles,

Ethereum’s recent software upgrade the ‘Merge’ is a key step in its future roadmap of development, but there remain several challenges that this emerging…

DatafilesDatafiles,

Datafiles,

Alternative credit is flourishing in Thailand as big technology platforms fill in the lending gaps left by traditional financial institutions. Known for…

DatafilesDatafiles,

Datafiles,

Banks have not experienced a significant deterioration in asset quality of their MSME exposure, supported by various policy measures. An uptick in the…

DatafilesDatafiles,

Datafiles,

Banks have not experienced a significant deterioration in asset quality of their MSME exposure, supported by various policy measures. An uptick in the…

DatafilesDatafiles,

Datafiles,

The weak sales growth for this year’s Double 11 shopping festival was largely driven by the depressed consumer sentiment and logistical disruptions under…

DatafilesDatafiles,

Datafiles,

DBS CEO Piyush Gupta, Public Bank CEO Tay Ah Lek and UOB CEO Wee Ee Cheong are the top three highest-paid bank chief executives in Asia Pacific in FY 2021.…

DatafilesDatafiles,

Datafiles,

Despite the impressive figures, the banking industry has been slow in partnering with the United Nations Environment Programme Finance Initiative to set,…