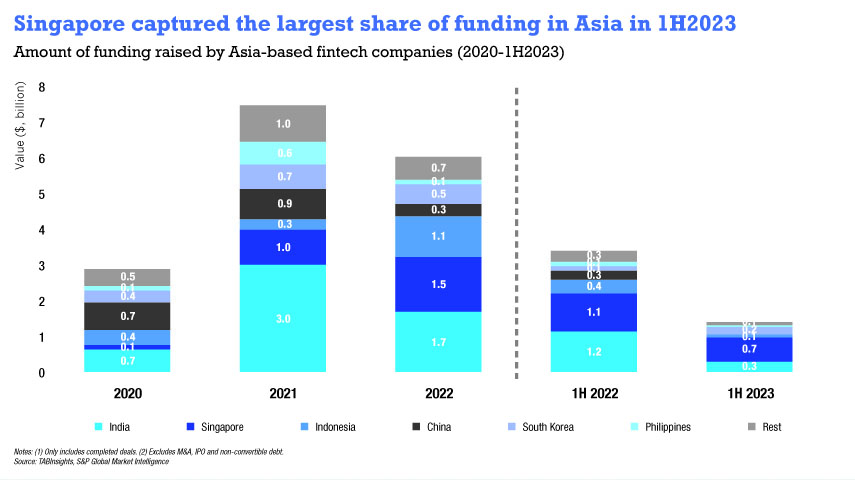

The funding environment for financial technology (fintech) companies in Asia has declined since 2022, with notable drops observed in India, China, and the Philippines. In 2022, Asian fintech companies experienced a 20% decrease in the amount of money raised, totaling $6 billion, compared to the previous year. The number of deals also slipped from 357 in 2021 to 281 in 2022. Despite the decline, fintech funding in 2022 remained twice the level of 2020. The trend continued in the first half of 2023 (1H2023) with a more significant downturn—59% decrease in funds raised and a 49% drop in the number of deals compared to 1H2022.

Singapore's share of deal value surged to 48% in 1H2023, up from 13% in 2021

Between 2020 and 2022, India led fintech funding in Asia with a 33% share, followed by Singapore at 16%, China at 12%, and Indonesia at 11%. However, in 1H2023, Singapore surpassed India, securing the largest funding share of 48% in Asia. India followed at 23%, South Korea at 15%, and Indonesia at 6%. In terms of deal volume, India maintained its lead with 37%, while Singapore accounted for 19%.

Singapore-based fintech companies accounted for 5% of total fintech funding in Asia in 2020. The share increased to 13% in 2021, 26% in 2022, and an impressive 48% in 1H2023. The surge in Singapore’s fintech funding during 1H2023 was driven by strong activities in the digital lending and insurance technology (insurtech) segments. Notably, credit fintech Kredivo secured $270 million in a Series D round, leading the funding drive, closely followed by insurtech startup Bolttech, that raised $196 million in a Series B round.

Fintech funding in Southeast Asia experienced a 22% increase in 2022, leading to the region’s share of fintech funding in Asia rising from 34% in 2021 to 52% in 2022. Alongside Singapore, Indonesia also witnessed robust fintech funding activities, driven primarily by the payments and digital lending sectors. However, the Philippines and Vietnam faced considerable declines in fintech funding.

Digital lending and insurtech overtook payments

From 2020 to 1H2023, the payments segment held the primary focus, accumulating $9.8 billion across 362 deals. However, its share fell from 63% in 2021 to 52% in 2022 and further to 23% in 1H2023. In contrast, digital lending and insurtech segments surged ahead in 1H2023, capturing 38% and 29% of total fintech funding in Asia, respectively.

In 2022, digital lending and insurtech segments were the only ones to witness increased funding. Digital lending companies experienced an 80% funding increase, raising $1.4 billion through 47 deals. Indian digital lending firms witnessed a substantial rise from $300 million to $848 million. In 1H 2023, insurtech companies secured a 79% funding increase. Singapore-based Bolttech, along with Policybazaar from India, Qoala from Indonesia, and OneDegree Hong Kong, amassed a combined funding of $403 million.

Given the challenging macro environment, fintech funding activities are expected to remain relatively weak in the second half of 2023. Fintech companies need to prioritise optimising their operational models and effectively managing their cash flow. Despite these challenges, Southeast Asia is expected to continue being an attractive region for fintech investment.

.webp)

.jpg)