- UOB demonstrated strong financial performance and customer digital engagement despite a challenging 2020

- The bank gave $2.2 billion worth of relief assistance to SMEs in Singapore

- UOB has the strongest customer digital engagement at 92%

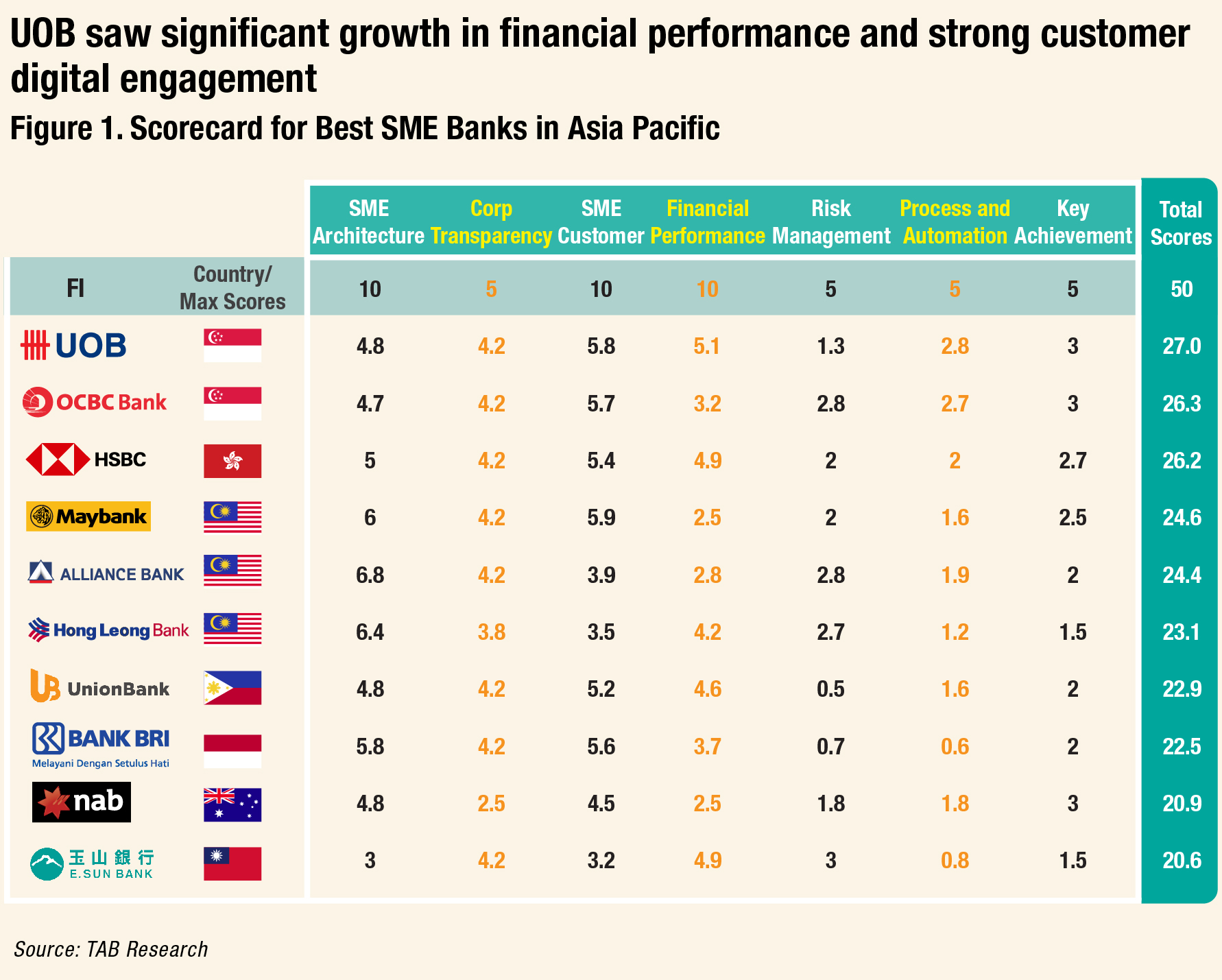

UOB was recognised as the Best SME Bank in Asia Pacific and Singapore at The Asian Banker International Excellence in Retail Financial Services Awards 2021.

UOB, OCBC and HSBC Hong Kong were the finalists in this year’s Best SME Bank in Asia Pacific and Singapore. UOB’s small and medium-sized enterprise (SME) customers increased year-on-year (YoY) and SME deposits grew significantly. Meanwhile, both OCBC and HSBC Hong Kong have a modest deposit growth.

Financials: UOB demonstrated strong financial performance and customer digital engagement despite a challenging 2020

UOB reported the highest operating profit in SME business among its peers. The bank has one of the highest return on assets (ROA) compared to its peers. Although all banks showed a weaker cost-to-income ratio (CIR) in 2020 compared to the previous year due to the impact of the pandemic, UOB maintained its solid financials with its strong CIR, the lowest among its peers. Meanwhile, the CIR of HSBC Hong Kong and OCBC slightly increased. UOB’s fee income contribution to total income also remained one of the highest. The bank also saw an increase in its SME outstanding balance in Singapore and in net promoter score.

Furthermore, UOB made productivity and efficiency its top priorities in order to support SMEs in achieving their business objectives. The bank leveraged digital transformation by integrating innovative solutions into SME business and saw more than two-fold growth in customer digital onboarding in the previous year. Digitalisation efforts have paid off as the bank improved processes and increased its new customer acquisition. The bank saw the strongest digital engagement of customers at 92%.

SME Alignment: The bank gave $2.2 billion aid to SMEs in Singapore

UOB has the largest share in the government’s assistance schemes to help SMEs amid the pandemic. The bank was first to commit $2.2 billion in relief assistance for SMEs. Recognising that small businesses including food and beverage (F&B) and retail SMEs needed alternative sources of revenue, UOB helped more than 10,000 of these companies digitalise and set up their online presence conveniently and quickly in 2020. This was done through the UOB BizSmart programme, a curated suite of partner business solutions that include F&B management solutions as well as accounting, invoicing, enterprise resource planning (ERP), payroll and human resource management.

The bank introduced UOB Infinity, a digital SME servicing platform that allows clients to manage their cash flow in real-time. It comprises a comprehensive range of payments and collection features and SMEs can submit trade transactions online with real-time tracking and notifications. It also provides increased visibility to track the cross-border payments end-to-end.

Process and Automation: UOB has the strongest customer digital engagement at 92%

UOB made a significant stride in leveraging digital transformation to expand its SME business. It introduced full end-to-end digital onboarding with video electronic know-your-customer (eKYC) function. The processing time for SME transactions was reduced and its digital customer onboarding level rose by more than two-fold between 2019 and 2020. The bank reported the highest digital active rate among its SME customers at 92%.

E-commerce merchants across Singapore, Thailand, and Vietnam had access to non-collaterised loans offered under UOB BizMerchant last year. UOB offered financing to small businesses and tapped on data-driven financial technology to gain insights into the companies’ credit behaviour and provided for a digitalised application process that reduced the turnaround time to receive funds. BizMerchant has been expanded to include Malaysia and Indonesia in 2021.

“We have demonstrated our focus on valuing long-term relationships with our customers and it has proven that it’s the right thing to do in good and challenging times. We feel especially proud to have been recognised in a year, where we made a difference by reaching out to our customers impacted by COVID-19. Through our swift action, most of our customers who received relief assistance have since resumed phased recovery,” said Rosalind Lee, managing director and head of enterprise banking, group commercial banking at UOB.

Lawrence Loh, head of group business banking, group retail, said, “We affirm our continuous efforts in supporting SMEs through these times. The pandemic remains a fluid one that requires SMEs to constantly adapt to sustain and grow their business. For our part, this means helping SMEs pivot their business models to include new revenue sources from online channels as consumer behaviours shift; as well as capture new opportunities that arise as the economy recovers. We tap on our deep local market knowledge and the innovative solutions we deliver to SMEs so they can respond effectively to the challenges of the changing environment”.

Large SME banks partner with technology and fintech players to improve capabilities

BRI partnered with various e-commerce sites in Indonesia such as Tokopedia, Bukalapak, Blibli, Blanja, and Shopee. Through the programme, Bank BRI provides support to vendors by handling shipping and logistics. It also provides marketing support to major e-commerce platforms such as Tokopedia, Shopee, Bukalapak, Blanja, Blibli and Qoo10. Maybank launched an initiative to support SMEs. The bank partnered with several delivery platforms such as LalaMove to provide delivery capabilities which is fully funded by Maybank. OCBC provided working capital through extended loans and relief measures to various SMEs in Singapore to support their growth opportunities.

UOB introduced new products and reduced friction for its SME customers

UOB made significant strides by leveraging its digital transformation to expand its SME business. It introduced full end-to-end digital onboarding with video eKYC. As a result, processing time for SME transactions was reduced to less than 10 minutes and raised its digital onboarding level to 50% in 2020 compared to 21% from the previous year. The bank reported the highest digital active time period of its SME customers at 92%. It also launched BizSmart, a suite of business solutions integrated with a UOB bank account that covers accounting, invoicing, ERP, payroll, HR management, e-commerce, and food and beverage management solutions. To date, about 4% of SMEs use the platform regularly based on total SME accounts in the region. In addition, the bank introduced BizMerchant, a non-collaterised loan for its e-commerce merchants.

All Comments