- BCA, BNI and Mandiri topped consumer votes for Most Recommended Retail Bank

- Bank Jago, Indonesia’s homegrown digital bank, led across multiple product categories

- Dana was voted the most helpful financial institution in reducing living costs

The BQS™ Consumer Survey and Rankings is a digital consumer feedback channel developed by The Asian Banker. It surveyed 1,000 online customers across Indonesia to understand their engagement, experience, and satisfaction with retail financial services institutions based on their experience with service, channels, products, and support in managing living costs.

BCA, BNI and Mandiri topped consumer votes for Most Recommended Retail Bank

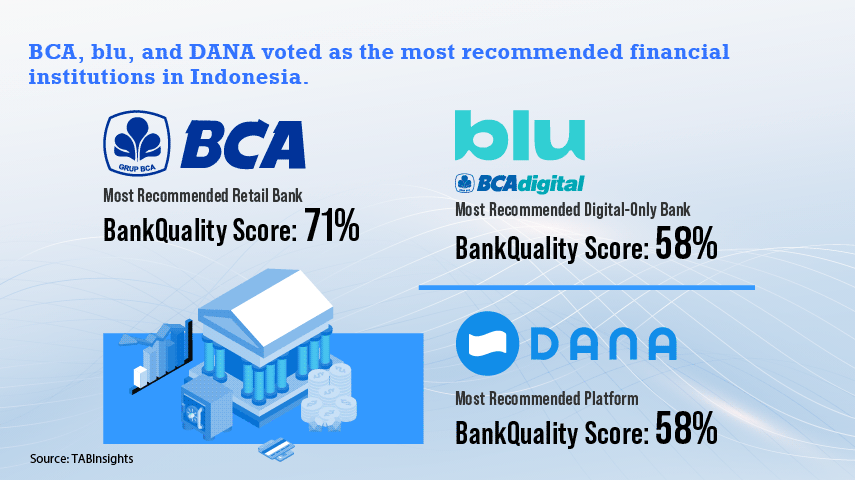

Bank Central Asia (BCA) ranked as the Most Recommended Retail Bank in Indonesia with a BankQuality™ Score of 71%. Consumers found BCA to be a reliable financial services provider that can adapt to changing market conditions. BCA outperformed competitors in four out of six categories in the BQS™ channel score that covers internet banking, branch banking, phone banking, and relationship management.

Bank Negara Indonesia (BNI) ranked second and Bank Mandiri third in the category, followed by Bank Rakyat Indonesia, and Bank Neo Commerce.

Bank Jago, Indonesia’s homegrown digital bank, led across multiple product categories

Consumers emphasised the ease of transactions, promotions, and low fees as the key drivers of their votes. BCA registered a 71% year-on-year (YoY) increase in deposit customers from 1.4 million in 2021 to 2.3 million in March 2022.

GoTo’s acquisition of a 22% stake in Bank Jago in December 2020 helped boost the bank’s lending, enabling it to achieve profitability in 2021. Through ecosystem collaboration, the bank disbursed $360 million in loans in 2021, and $480 million in 2022.

While Bank Jago ranked high in the BQS™ Product Score, it was blu, BCA’s digital bank, that consumers voted as the Most Recommended Digital Bank in Indonesia. Blu acquired more than 1.1 million customers in 2022, a YoY growth of 100%, and managed nearly IDR 72 trillion ($4.6 billion) in transactions.

Dana was voted by consumers as the Most Recommended Platform, trumping GoPay and OVO. With more than 115 million users, it operates in Indonesia’s top 20 cities, and in 50% of Indonesia’s other cities.

Dana was the most helpful financial institution in reducing the cost of living

It was also voted as the Most Helpful Main Retail Financial Institution in reducing the cost of living, the category in which financial institutions are scored based on how helpful they are in providing extra savings, with reminders of upcoming charges such as bills, overdrafts, outstanding balances, and below-minimum balances on deposit accounts. Dana was followed by BCA in this category.

Survey methodology for Indonesia

The BankQuality™ Survey was conducted from January to February 2023 in Indonesia, with 1000 participating respondents nationwide. To determine the BankQuality™ Score, we derive the response set from a scale of 0 to 1. In calculating the scores for the products and channels category, we used the weighted BankQuality™ Score from values garnered by financial institutions in both primary and secondary bank classification, and then weighted the average score based on total surveyed votes in the primary and secondary category.

Members of TABInsights can now access the comprehensive BQS™ Indonesia report, that includes a detailed breakdown of BQS™ scores for various institutions, products, and channels.

.webp)

.jpg)