Back to publication homepage

Issue No 177

Making sense of the AB500 strongest banks ranking

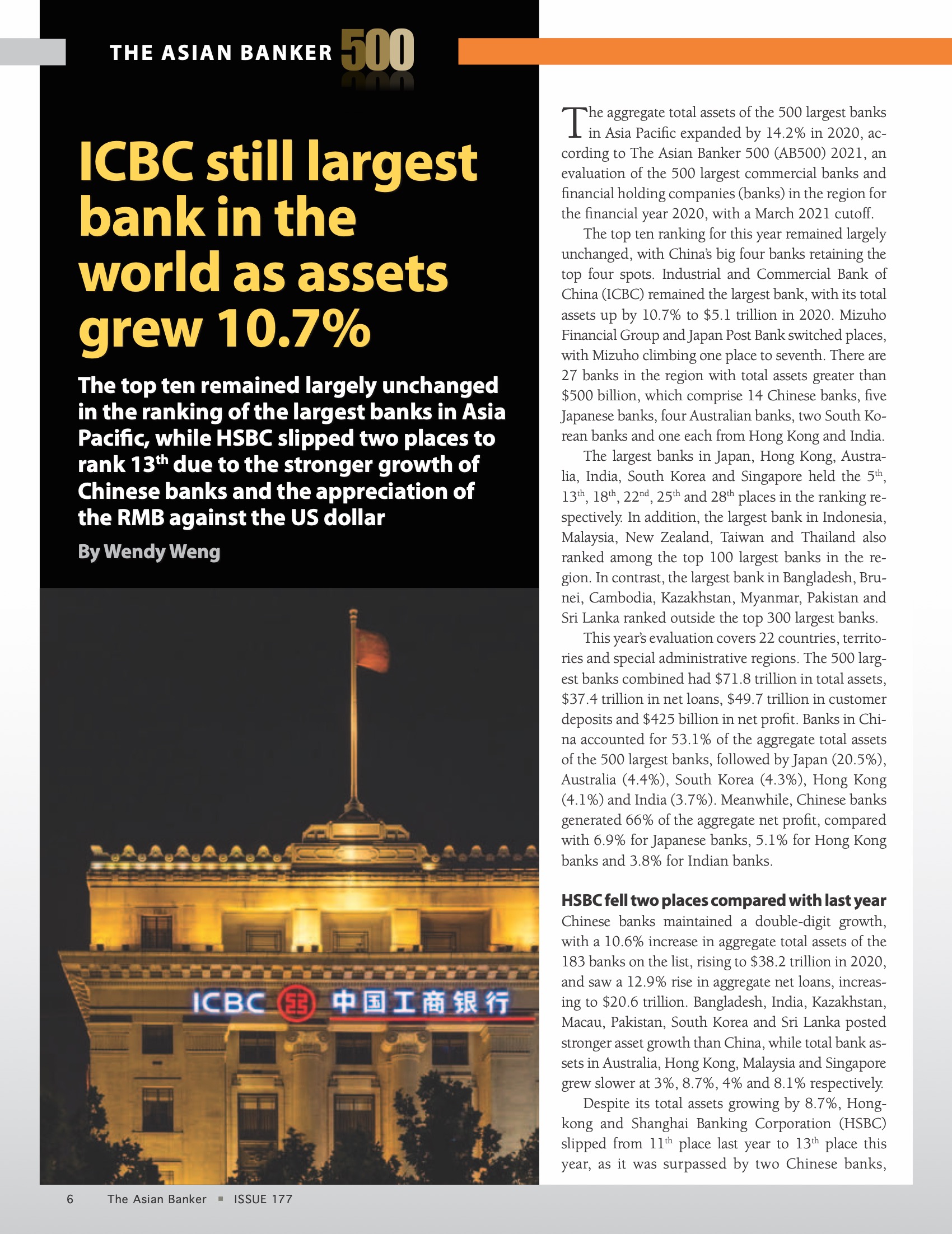

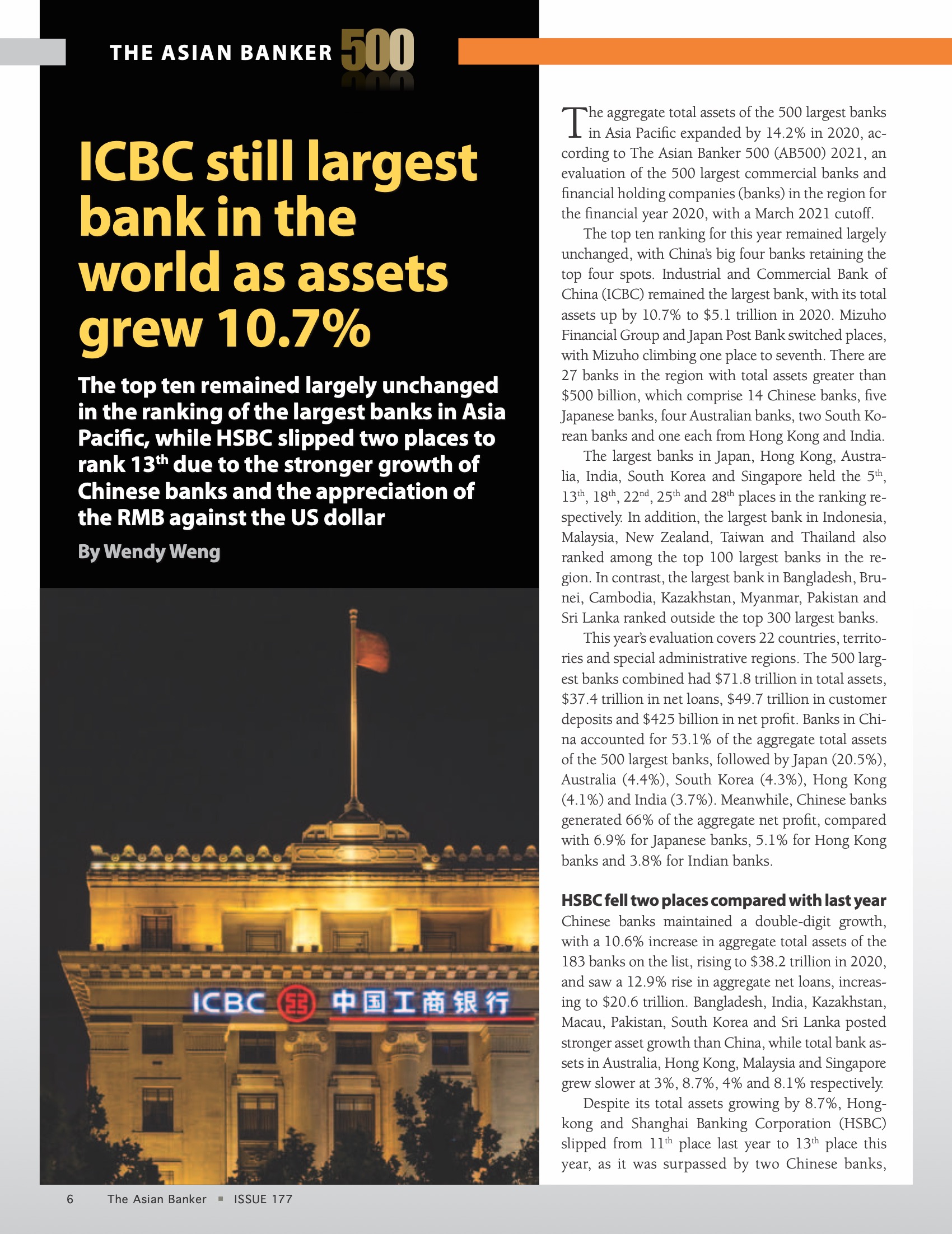

The Asian Banker 500 (AB500) was started in 2001 in the wake of the Asian financial crisis, which saw the collapse and consolidation of financial markets and systems in the region. The ranking attempted to provide the first independent and objective measure of the strength of banks that emerged from the deep reform and recapitalisation that followed the crisis. It is based on a detailed and transparent scorecard that ranks commercial banks and financial holding companies on six criteria of balance sheet performance; namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity, covered by 12 specific factors.

This year, to better reflect the impact of the pandemic on the balance sheet performance of banks, specific consideration was given to the impact of banks’ digitalisation and social distancing measures on cost to income ratio (CIR) and cost of funding, impact of state supported credit relief and repayment moratorium on asset quality, and impact of historical low interest rate on net interest margin, income and profitability.

A statistical analysis was conducted to determine the correlation between the 12 balance sheet factors and the overall strength score of the 500 banks evaluated show that loan loss reserves to gross non-performing loans (LLRs/GNPLs) ratio, CIR, capital adequacy ratio (CAR) and assets to GDP ratio were significantly correlated to the overall strength score.

Preview

From Our Publication

×