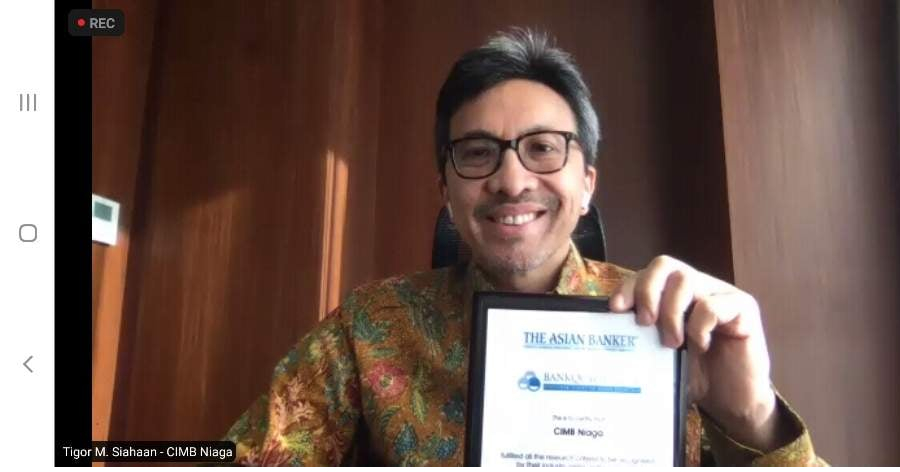

The Asian Banker’s Retail Finance and Technology Conference 2021 will capture some of the best practices demonstrated by various financial institutions and their preparedness to compete and win in the post COVID-19 digital world. The programme has been designed for senior executives from banks, financial institutions, fintech and large technology companies to come together for a day of intense discussions on the current themes that are reshaping the financial services industry.