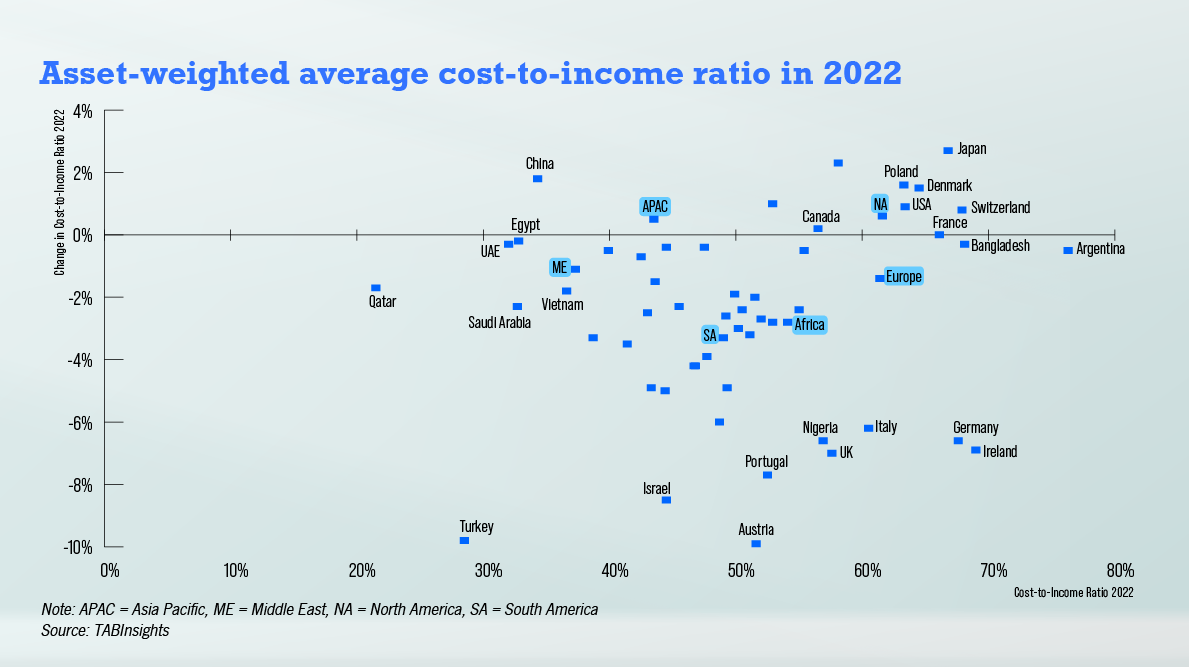

- In 2022, approximately 70% of jurisdictions improved average cost-to-income ratios

- Qatari banks exhibited the lowest CIR, indicating robust operational efficiency

- Qatar Islamic Bank is the most efficient bank among those with at least $20 billion in assets

The asset-weighted average cost-to-income ratio (CIR) for the world’s 1000 largest banks stood at 51.8% in 2022, according to the TAB Global 1000 World’s Largest and Strongest Banks Ranking 2023 by TABInsights, The Asian Banker’s research arm. This ratio quantifies operating expenses as a percentage of operating income, signalling bank efficiency and productivity.

The average CIR for these banks exhibited a modest improvement from 52.1% in 2021. Among the jurisdictions with at least five banks featured in the TAB Global 1000, about 70% reported an enhancement in average CIR for 2022, reflecting a commitment to cost reduction and operational efficiency.

Middle East leads with lowest asset-weighted CIR across regions

Among regions, banks in the Middle East registered the lowest asset-weighted average CIR at 37%, followed by banks in the Asia Pacific and South America. Banks in Qatar, the UAE, and Saudi Arabia have the lowest CIR in the world. The weighted average CIR of Qatari banks improved from 23.3% in 2021 to 21.5% in 2022, outperforming the already-low regional norms. This was the result of investments in IT infrastructure that enabled these banks to deliver cost-effective digital services, and streamlined branch networks for smaller populations. The average CIR for banks in the UAE and Saudi Arabia stood at 32% and 32.7%, respectively.

In Asia Pacific, Chinese and Vietnamese banks maintained the highest cost efficiency, with average CIRs of 34.3% and 36.6%, respectively. In contrast, banks in Bangladesh and Japan demonstrated the least cost efficiency, with average CIRs of 68.1% and 66.8%, respectively. Banks in India, the Philippines, and Taiwan also reported CIRs exceeding 50%. Furthermore, banks in China, India, and Japan saw increased CIRs in 2022 compared to 2021, resulting in a slight rise in the average CIR of Asia Pacific banks from 43.1% in 2021 to 43.5% in 2022.

Contrasting CIR trends in US and Europe

Banks in North America and Europe reported higher average CIRs, at 62% and 61%, respectively. Banks in North America experienced a worsening average CIR, rising from 62.5% in 2021 to 63.4% in 2022. The average CIRs of banks in Canada and Mexico stayed lower at 56.5% and 46.8%, respectively.

European banks saw an improvement in CIRs. Austria, Turkey, Portugal, the UK, Ireland, Germany, and Italy in Europe witnessed some of the most significant improvements in average CIR. The average CIR of UK banks improved from 64.6% in 2021 to 57.6% in 2022, as all UK banks in the TAB Global 1000 reported lower CIRs. Despite a decline in the average CIR from 75.9% in 2021 to 69% in 2022, the average CIR of Irish banks remained the highest in Europe, followed by Switzerland (67.9%), Germany (67.6%), France (66.1%), and Denmark (64.5%).

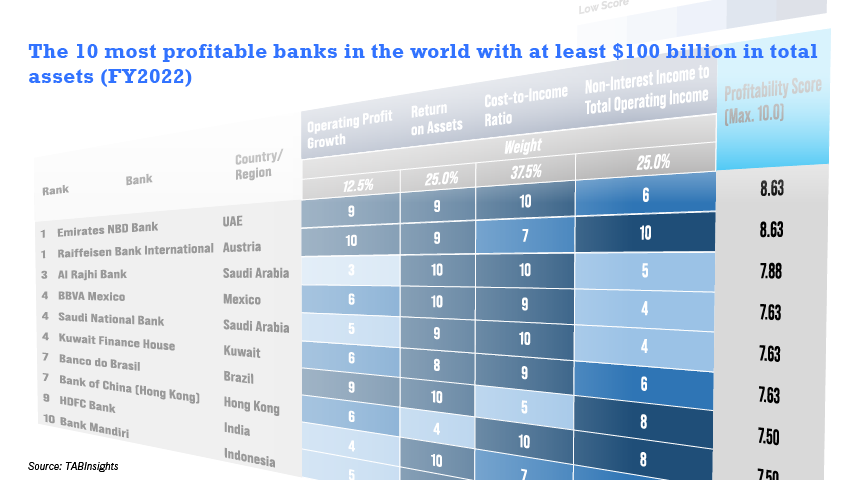

Top 10 most efficient banks in the world

Among the world's 1,000 largest banks, 63 recorded CIR below 30%, distributed across regions as follows: 35 in Asia Pacific, 15 in the Middle East, 11 in Europe, and two in North America. Additionally, 167 banks reported CIR ranging between 30% and 40%, while 45 banks had CIR exceeding 80%.

The 10 most efficient banks among those with at least $20 billion in total assets comprise three Qatari banks, three Turkish banks, and one each from China, Egypt, Kazakhstan, and Vietnam. These banks achieved CIRs ranging from 17% to 23%.

Qatar Islamic Bank (QIB) and Qatar National Bank (QNB) led the list. QIB reported 6.5% growth in operating income and 2.5% increase in operating expenses, leading to a reduction in its CIR from 18.1% in 2021 to 17.4% in 2022. This improvement was a result of strategic technology investments and effective cost management practices. Similarly, QNB's CIR improved from 22.7% in 2021 to 20% in 2022, driven by innovation that boosted the bottom line and new revenue streams.

In Asia Pacific, China’s Weihai City Commercial Bank and Vietnam’s Saigon-Hanoi Commercial Joint Stock Bank (SHB) stand out as the most efficient banks among those with at least $20 billion in total assets. SHB’s CIR decreased from 25.2% in 2021 to 23% as the bank diversified its income structure, reducing reliance on lending. It also strictly controlled costs and invested in advanced technology to enhance efficiency.

.webp)

.jpg)