Islamic banks experienced a notable upswing in overall profitability in financial year (FY) 2022 compared to the prior year, with around 70% of the top 100 largest in the world showcasing improved return on assets (ROA). These insights result from a comprehensive assessment of the 100 largest Islamic banks and financial holding companies globally for FY 2022, with a cutoff date in March 2023. The evaluation spans 26 countries, ranking the banks based on asset size and overall strength.

Al Rajhi Bank, headquartered in Saudi Arabia, maintained its standing as the world’s largest and strongest Islamic bank with a 22% surge in total assets, reaching $203 billion in 2022. The evaluation is conducted using a comprehensive and transparent scorecard, assessing the banks in six areas of balance sheet financial performance, namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity, encompassing 14 specific factors. In this year’s assessment, two new factors have been incorporated: the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR). These financial metrics gauge a bank’s ability to meet short-term and long-term liquidity requirements.

Islamic banking is gaining global traction due to its alignment with environmental, social, and governance (ESG) principles. Rooted in Shariah, it avoids the imposition of interest and emphasises ethical practices such as profit-and-loss sharing, which resonates with ESG’s sustainability focus. It prohibits investments in non-Shariah compliant activities and aligns with socially responsible criteria that attract investors who are seeking ethical financial solutions. The commitment to tangible assets and real economic activities contributes to sustainable development, reinforcing its appeal in the growing context of ESG considerations and the global movement towards responsible finance.

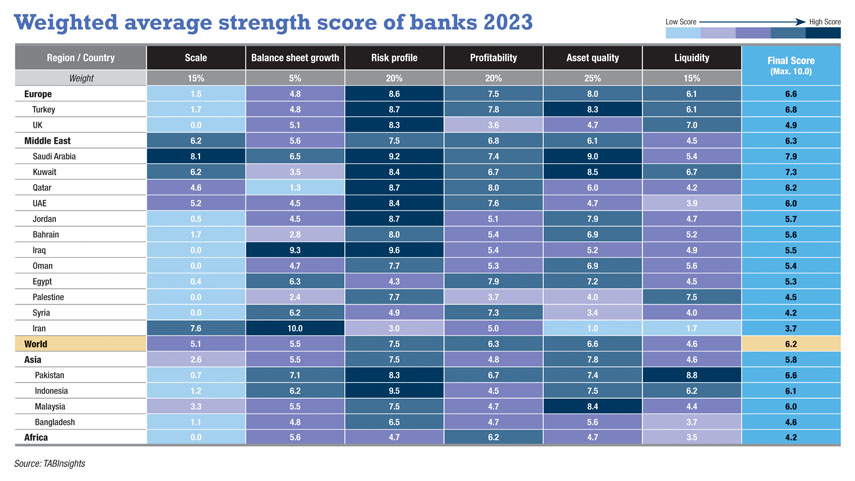

Saudi Arabia, Kuwait, Turkey and Pakistan showed highest overall strength

In assessing the comprehensive strength of the Islamic banking sector, Europe emerged with the highest weighted average strength score of 6.6 out of 10, surpassing the Middle East at 6.3. Asian and African Islamic banks recorded strength scores averaging 5.8 and 4.2, respectively, falling below the overall average of 6.2 for all 100 banks. The Middle Eastern banks exhibited greater scale and profitability compared to their Asian counterparts, while Asian Islamic banks showed stronger asset quality. Compared to Islamic banks in Europe, those in the Middle East performed better in scale and balance sheet growth but lagged in risk profile, profitability, asset quality and liquidity.

Among the 26 nations, Saudi Arabia, Kuwait, Turkey, and Pakistan achieved the highest average strength scores, recording 7.9, 7.3, 6.8, and 6.6, respectively. In the previous year’s ranking, Saudi Arabia secured the highest score, followed by Turkey, Qatar and Kuwait. Islamic banks in Qatar experienced a decline in financing and deposits in 2022, along with a rise in gross non-performing financing (NPF) ratio. Meanwhile, Islamic banks in Pakistan demonstrated improved profitability and capitalisation in 2022.

The banks in Saudi Arabia showcased robust capitalisation, with the average Tier 1 capital ratio and capital adequacy ratio (CAR) strengthening to 19% and 21%, respectively. These Islamic banks also maintained an average gross NPF ratio of 1% and a provision coverage ratio of 232%. Furthermore, the profitability of these banks remained robust, with an average ROA of 2.1% and an average cost-to-income ratio (CIR) of 32%.

Islamic banks in Kuwait exhibit superior liquidity compared to their counterparts in Saudi Arabia. The weighted LCR for banks in Kuwait reached 181%, surpassing the 134% reported for banks in Saudi Arabia. Moreover, banks in Kuwait performed well across dimensions such as scale, risk profile, and asset quality. However, certain Middle Eastern countries, including Egypt, Iran, Oman, and Palestine, received lower scores, contributing to a lower average score for the Middle East compared to Europe. Banks in Turkey demonstrated stronger profitability and liquidity than banks in Saudi Arabia.

In Asia, Islamic banks in Pakistan exhibited the highest financial strength, propelled by exceptional performance in balance sheet growth, profitability, and liquidity. On average, Islamic banks in Pakistan saw 22% and 16% year-on-year (YoY) increase, respectively, in net financing and deposits in 2022. The average ROA of Islamic banks in Pakistan improved from 1.3% in 2021 to 1.6% in 2022. Additionally, the average LCR of Pakistan’s banks rose from 210% in 2021 to 258%, while the average NSFR remained robust at 167%.

Indonesia’s Islamic banks achieved a superior average score in risk profile, while Malaysia’s excelled in scale and asset quality. Islamic banks in Indonesia reported a substantial average CAR of 24.2%, surpassing 19.5% for Malaysia and 18.1% for Pakistan. The average gross NPF ratio for Malaysia’s Islamic banks was 1.5%, lower than the 2.3% for Indonesia and the 3.2% for Pakistan.

Saudi Arabia tops Islamic assets and net profit despite Malaysia having more Islamic banks

The 100 largest Islamic banks had $1.57 trillion in assets, $1 trillion in net financing, $1.15 trillion in deposits, and $24.4 billion in net profit. The ranking includes 45 Asian, 42 Middle Eastern, nine European, and four African banks.

Saudi Arabia, UAE, and Qatar have strong Islamic banking industries, making the Middle East a hub for Islamic finance. Though fewer than Asia, Islamic banks in the Middle East provided 71.6% of the 100 Islamic banks’ total assets, compared to 23.6% in Asia. Asia’s banks reported 13.8% net profit, while Middle Eastern banks had 77.7%. Saudi Arabia held 20.4% of total assets, ahead of Malaysia (16.7%), Iran (14.3%), Kuwait (10.9%), and the UAE (10.8%).

Islamic banking is important throughout Asia, especially Malaysia, Indonesia, Pakistan, Bangladesh, and Brunei. With 17, 10, 9, and 5 Islamic banks, respectively, Malaysia, Indonesia, Bangladesh, and Pakistan are well-represented. However, Islamic banks own only 3%, 2%, and 1.1% of total assets, respectively, in Bangladesh, Indonesia, and Pakistan.

Islamic banking is also growing in Europe and Africa. The ranking includes six banks from Turkey, two from UK, and one from Germany. Turkish banks had 4.1% of total assets and 7.8% of net profit. The global list includes one Islamic bank each from Algeria, Nigeria, South Africa, and Sudan. Despite challenges such as competition and limited awareness, Islamic banking in Africa is progressing, buoyed by regulatory support in some countries.

Largest Islamic banks in the world: Al Rajhi Bank, Tejarat Bank and Kuwait Finance House

Three Islamic banks reported total assets exceeding $100 billion, while an additional five fell within the $50 to $100 billion range. Islamic banks, in general, remain considerably smaller compared to their conventional counterparts, with only 35 banks surpassing the $10 billion asset threshold. In contrast, over 840 conventional banks in the TAB Global 1000 ranking of the largest banks in the world exceed the $10 billion asset mark.

The top 10 largest Islamic banks globally include two each from Saudi Arabia, Iran, UAE and Qatar, and one each from Kuwait and Malaysia. The rankings consider only Islamic banks with financial data available for FY 2022, excluding Iran’s Tejarat Bank and Bank Pasargad, whose data is from the financial year ending 31 March 2022. Tejarat Bank and Bank Pasargad placed second and fourth in the ranking of the largest Islamic banks.

Kuwait Finance House rose to become the third-largest Islamic bank, surpassing Bank Pasargad and Dubai Islamic Bank. This shift came after its acquisition of Ahli United Bank in Bahrain, currently transitioning from a conventional to an Islamic bank. Its total assets stood at $120 billion at the close of 2022, remaining 69% smaller than Al Rajhi Bank.

Meanwhile, Dubai Islamic Bank, the largest Islamic bank in the UAE, moved from the fourth position in last year’s ranking to the fifth. Alinma Bank in Saudi Arabia, on the other hand, outpaced Qatar Islamic Bank and Masraf Al Rayan, securing the seventh position. Alinma Bank’s total assets saw 15.5% YoY growth in 2022, while Qatar Islamic Bank and Masraf Al Rayan saw declines of 5.1% and 3.8% YoY, respectively.

Maybank Islamic maintained its position as the sixth-largest Islamic bank globally and the only one from Asia among the top 10 largest worldwide. Among the top 10 largest Islamic banks in Asia, eight are in Malaysia, with one each from Bangladesh and Indonesia. Maybank Islamic’s total assets reached $66 billion by the end of 2022, surpassing Bank Syariah Indonesia, the largest Islamic bank in Indonesia with $20 billion, Islami Bank Bangladesh with $17 billion, and Pakistan’s Meezan Bank with $11 billion.

World’s strongest Islamic bank, Al Rajhi, excels in all aspects but liquidity

The bulk of the top 10 Islamic banks worldwide performed well in risk, asset quality, and profitability. With an 8.5 strength score, Al Rajhi Bank remains the strongest globally. Kuwait Finance House and Qatar Islamic Bank followed closely in second and fourth places. Turkey’s Turkiye Emlak and Kuveyt Turk banks placed third and seventh. Meezan Bank in Pakistan and Maybank Islamic in Malaysia placed sixth and 10th.

Al Rajhi Bank excelled everywhere except liquidity. The bank grew net financing 25.5% and consumer deposits 10.3% YoY. With a 26% CIR and 2.45% ROA, the bank was profitable, and maintained strong capital, with its CAR rising from 17.5% in 2021 to 21.4% in 2022. With a provision coverage ratio of 260% and a gross NPF ratio of 0.54% in 2022, asset quality remained strong.

Kuwait Finance House had an LCR of 182%, compared to 126% for Al Rajhi Bank and Qatar Islamic Bank. Kuwait Finance House’s gross NPF ratio rose from 1.7% in 2021 to 1.4% in 2022, over Qatar Islamic Bank’s 1.5%. Qatar Islamic Bank is the most efficient Islamic bank, with a CIR of 17.4% in 2022, up from 18.1% in 2021. ROA was 2.1%, surpassing Kuwait Finance House’s 1.8%. Qatar Islamic Bank’s CAR was 19.9%, surpassing Kuwait Finance House’s 17.7%.

In Asia, the top 10 strongest Islamic banks consist of five in Malaysia, three in Indonesia, and two in Pakistan. Asian Islamic banks Meezan Bank, Maybank Islamic, and Bank Syariah Indonesia rank highest. Maybank Islamic scored on scale and asset quality, Meezan Bank on balance sheet expansion, profitability, and liquidity, and Bank Syariah Indonesia on risk profile strength.

Meezan Bank’s ROA rose from 1.7% in 2021 to 2.0% in 2022, surpassing Bank Syariah Indonesia’s 1.5% and Maybank Islamic’s 1.1%. However, Maybank Islamic had a lower CIR of 29% than Meezan Bank (34%), and Bank Syariah Indonesia (56%). Maybank Islamic had a 0.9% gross NPF ratio, compared to Meezan Bank’s 1.3% and Bank Syariah Indonesia’s 2.4%. Meezan Bank’s liquid assets-to-total deposits ratio was 54%, beating Maybank Islamic’s 15%. Meezan Bank’s LCR rose from 222% in 2021 to 284% in 2022.

Islamic banking witnessed significant advancements, including the grant of the first Islamic banking unit license to a conventional bank in the Philippines in August 2023, and Uganda’s issuance of its first Islamic banking license in September 2023, while Australia’s Islamic Bank Australia will launch in 2024. This expansion of Islamic banking is fuelled by increasing demand, greater awareness among non-Muslims, and product innovations.

To view the full ranking: World's Largest Islamic Banks

.webp)

.jpg)