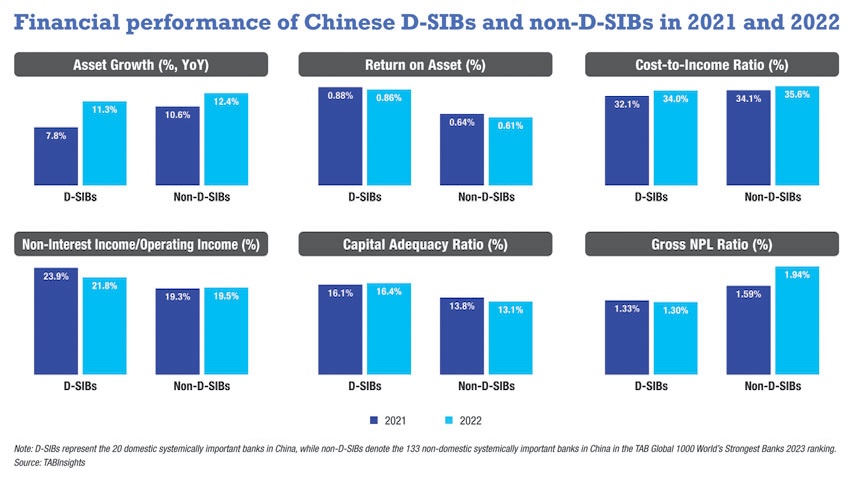

- Chinese domestic systemically important banks (D-SIBs) outperformed non-D-SIBs in various aspects apart from balance sheet growth

- China Merchants Bank, Bank of Ningbo, and China Construction Bank rank as the top three strongest banks in China, according to the TAB Global 1000 World’s Strongest Banks 2023 ranking

- D-SIBs like Bank of Shanghai, Ping An Bank, and China CITIC Bank, face heightened pressure to strengthen capital positions

In 2023, the number of Chinese domestic systemically important banks (D-SIBs) grew to 20 with the inclusion of Bank of Nanjing (BONJ). D-SIBs are made up of six state-owned commercial banks, nine joint-stock commercial banks, and five city commercial banks. These banks collectively held total assets of $34 trillion by the end of 2022 that accounted for 63% of the total assets of the Chinese banking system.

The TAB Global 1000 World’s Strongest Banks 2023 ranking covers 153 Chinese banks. These 20 D-SIBs outshine the remaining 133 non-D-SIBs in all aspects except balance sheet growth. The top three strongest banks in China are China Merchants Bank (CMB), Bank of Ningbo (BONB), and China Construction Bank (CCB). This ranking assesses the 1,000 largest banks globally based on their strength, using a comprehensive and transparent scorecard that evaluates banks according to six criteria: scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity, covering a total of 14 specific factors.

Financial performance of Chinese D-SIBs

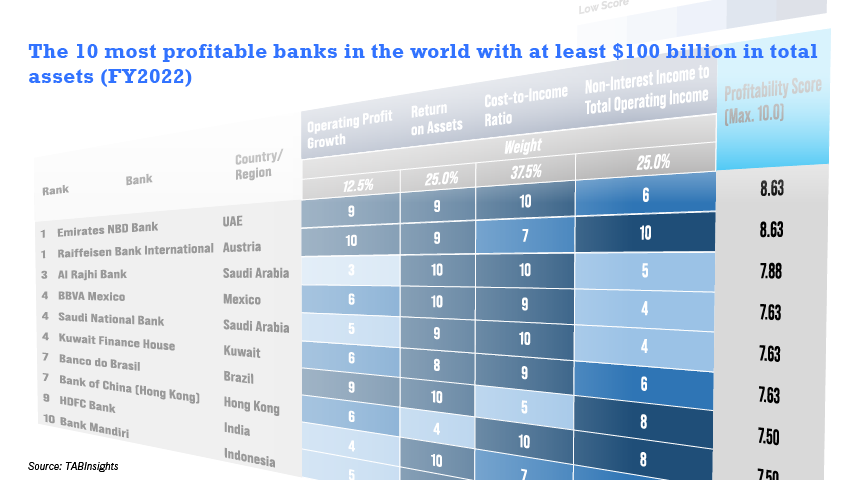

The 20 D-SIBs saw the weighted-average return on assets (ROA) fall from 0.88% in 2021 to 0.86% in 2022. This decline was primarily due to slower operating income growth, increasing by only 0.2% in 2022 compared to the 7.5% growth in 2021. Several factors, such as loan rate cuts, initiatives to lower financing costs for the real economy, and market fluctuations, contributed to this slowdown. Nonetheless, the average ROA for D-SIBs remained higher than that of non-D-SIBs, which stood at 0.61%. CMB, BONB, and Industrial Bank achieved ROAs above 1% in 2022, while China Guangfa Bank (CGB) and China Minsheng Banking Corporation (CMBC) had lower ROAs compared to other D-SIBs.

The average cost-to-income ratio for D-SIBs increased from 32.1% in 2021 to 34% in 2022, remaining below the 35.6% average for non-D-SIBs. This rise was mainly due to strategic transformation and infrastructure improvement. Bank of Shanghai had the lowest cost-to-income ratio at 24.1%, while Postal Savings Bank of China (PSBC) had the highest at 61.8%. While D-SIBs maintained a higher average non-interest income to total operating income ratio compared to non-D-SIBs, the overall ratio for Chinese banks fell below the global average. Among D-SIBs, Agricultural Bank of China (ABC) and CCB reported the lowest non-interest income to total operating income ratios at 14.6% and 15.3%, respectively.

The D-SIBs strengthened their capital levels, with the average total capital adequacy ratio rising from 16.1% in 2021 to 16.4% in 2022. In contrast, non-D-SIBs saw their average capital adequacy ratio decline from 13.8% in 2021 to 13.1% in 2022. Despite increased real-estate sector risks, the average gross non-performing loan (NPL) ratio for these 20 banks improved from 1.33% in 2021 to 1.3% in 2022, driven by enhanced NPL resolution efforts. Conversely, non-D-SIBs saw their gross NPL ratio increase from 1.6% in 2021 to 1.9% in 2022. BONB, PSBC, Bank of Jiangsu, BONJ, and CMB all maintained gross NPL ratios below 1% in 2022.

Chinese D-SIBs in the Strongest Banks 2023 ranking

The D-SIBs in China are classified into five buckets that indicate their systemic importance. Up to this point, no banks have been placed in Bucket Five. Bucket Four includes the four largest state-owned banks: Industrial and Commercial Bank of China (ICBC), CCB, Bank of China (BOC), and ABC. All four of them secured positions among the top 10 strongest banks in China in the TAB Global 1000 World’s Strongest Banks 2023 ranking, with CCB and ICBC jointly ranking third in China.

Bucket Three comprises Bank of Communications (BoCom), CMB, and Industrial Bank. CMB is the strongest bank in China, owing to its exceptional performance in profitability, asset quality, and risk profile. Among these 20 D-SIBs in China, CMB achieved the highest score in profitability, assessed using four indicators: operating profit growth, ROA, cost-to-income ratio, and non-interest income to total operating income ratio. CMB saw its ROA increase from 1.37% in 2021 to 1.45% in 2022, the highest among Chinese banks. With a leading position in wealth management, CMB achieved a non-interest income to total operating income ratio of 36.6%, second only to BONJ that had a ratio of 39.6%.

Bucket Two includes China CITIC Bank (CITIC), Shanghai Pudong Development Bank (SPDB), and PSBC. Among these, only CITIC secured a place in the top 10 strongest banks in China. PSBC received the lowest scores in the risk profile and profitability.

Within Bucket One, Bank of Ningbo ranked second in China, surpassing other D-SIBs in asset quality, balance sheet growth, and liquidity. Bank of Ningbo reported the lowest gross NPL ratio among the 20 D-SIBs at 0.75% in 2022; its provision coverage ratio was the highest, exceeding 500%. CMBC, Hua Xia Bank, and CGB are ranked beyond the top 30 strongest banks in China.

Capital pressure

Apart from the minimum regulatory capital requirements, the capital conservation buffer, and the countercyclical buffer, these D-SIBs must meet certain requirements regarding capital surcharge with their common equity Tier 1 capital. Banks in buckets one to five are subject to a capital surcharge of 0.25%, 0.5%, 0.75%, 1%, and 1.5%, respectively, according to The Supplementary Regulatory Rules for Systemically Important Banks (Trial). Meanwhile, Chinese regulators initiated draft consultations for new capital rules for commercial banks in February 2023, aiming for implementation on 1 January 2024. These rules classify banks into three buckets based on exposure scale, in alignment with the international Basel III standard.

Among the 20 D-SIBs, CMB maintained the highest Tier 1 capital ratio at 15.7%, closely followed by the four largest state-owned banks in Bucket One. BONJ saw the most significant rise in its Tier 1 capital ratio, attributable to its initiatives to fortify its capital base and acquire additional funding through various avenues. Additionally, CGB, CMB, BOA, and ICBC also exhibited notable enhancements in their capital levels.

Bank of Shanghai had the lowest Tier 1 capital ratio among these D-SIBs, standing at 10.1%, followed by Ping An Bank (10.4%) and CITIC (10.6%). The Tier 1 capital ratios of CGB, BONB, Bank of Jiangsu (BOJS), CMBC, and SPDB were also below 11%. Notably, CITIC and SPDB are categorised in Bucket Two. The Tier 1 capital ratio of Industrial Bank in Bucket Two saw a slight decline to 11.1%. Meanwhile, PSBC and BoCom experienced the most significant declines in their Tier 1 capital ratios in 2022. While Chinese D-SIBs have generally been actively raising additional capital, these banks still face substantial pressure to enhance their capital position.

To view the full list of the Largest Banks: https://tabinsights.com/ab1000/largest-banks-in-the-world

.webp)

.jpg)