Customers are seeking more interactive, hyper-personalised and fast customer experiences. To improve instant and personalised access to financial services, banks in recent years have launched non-scripted chatbots based on natural language processing (NLP).

The use of chatbots resulted in reduced response and wait times, and also reduced call abandonment rates. Chatbots help banks address customer queries around the clock and help users navigate complex banking platforms. They handle high volumes of business inquiries and complaints, and facilitate simple transactions, leaving more complex issues to human intervention.

WeBank China deploys one of the most advanced conversational AI bots. More than 95% of customer conversations are completed by the bank’s smart customer service robots, with an accuracy rate of more than 90%. The bots can manage loans for personal use, business loans for small and medium-sized enterprises, auto loans, and deposits.

Contrary to what industry marketing may imply, the majority of current chatbot apps predominantly rely on rules and intents to automate tasks and reduce call centre costs, rather than prioritise personalised customer needs to enhance their experience.

Customer expectations for conversational AI from their banks have increased as a result of the Generative Pre-trained Transformer (GPT) models with a conversational interface, such as ChatGPT and Google’s Bard.

Current chatbot applications in banks

Financial institutions are steadily migrating a greater proportion of their users to automated channels, with some leading players observing over 70% of their digital user base regularly engaging with chatbots. The predominant motivation behind this shift has largely been to enhance operational efficiencies, rather than prioritizing an improved customer experience. Even as the industry gradually transitions from script-based technologies to more advanced, non-scripted models, it's notable that 4 out of 10 chatbot services in the financial industry still operate on scripted and rule-based frameworks.

Chatbots have become prevalent in the customer-facing front end of banks to automate call centre functions and provide real-time interaction. Leading banks are adopting models that can handle more transactional use cases, reducing the need for transfers to live agents and improving accuracy. Personalised content and nudges based on customer preferences are being used to enhance self-service capability, call resolution and lead-conversion rates, and improve click-through rates.

Language comprehension has improved, along with the integration of chatbots and voice bots into virtual assistants, further enhanced by regional dialects and speech recognition, synthesis and print recognition. Chatbots are being integrated across multiple channels to improve customer access.

There is an increased focus on the growing use of high-volume transactions, for example, for card activation and financial inquiries. With advanced use cases for wealth and investment management such as robo advisors, financial institutions are using intelligent financial voice bots for credit, risk control and customer acquisition.

Technologies such as facial recognition, optical character recognition, image recognition, computer vision and biometrics are being added to improve processes such as customer authentication and reporting accuracy and efficiency, and reduce manual operation errors. By using bots, processing time in electronic know-your-customer (e-KYC) screening can be reduced by as much as 50%.

Developments in NLP

Traditional banking chatbots often struggle with issues surrounding intent recognition and context retention. In the case of simple queries, intent recognition rates fluctuate between 60% and 80%. However, this figure significantly declines to below 50% for more detailed queries, an issue particularly noticeable for non-English speaking bots. Furthermore, a vast majority of these chatbots lack the ability to retain and utilise contextual information from prior exchanges within a conversation thread, which impedes a more seamless communication and leads to customers abandoning the call or high hand-over rates to human customer service representatives.

As the adoption of AI in banking accelerates, chatbot technology is at the forefront of the digital customer service revolution. The GPT AI model developed by Open AI is setting new standards for conversational AI. Its advanced capabilities greatly surpass those of traditional banking chatbots, highlighting several significant gaps.

The GPT model effectively bridges the gaps in traditional models. GPT's large language model allows it to comprehend and respond to a wide range of customer queries, even those that are complex or layered. Its strong conversational capability mimics well a natural language environment while maintaining context throughout a conversation.

With the developments in generative AI and GPT technology, the cycle from data to intelligence has accelerated significantly. Banks can embed the underlying GPT technology in a secure and private environment to automate tasks, improve service efficiency, reduce the staff workload and improve customer service. This can result in more personalised responses, curated marketing campaigns, and allow banks to tailor communications based on the customer’s personality.

Generative AI provides the opportunity to be multi-modal. Customer communication such as emails can be contextualised, with personalised language that includes customised imagery, templates and even videos.

As these technologies evolve, banks must speed up their pace of innovation and adopt new capabilities while ensuring adequate security and compliance. These emerging developments must be embedded with well-balanced human oversight. Alongside this, banks need to address the growing challenges and requirements of AI ‘explainability’, algorithmic bias, regulatory compliance, and most importantly, data security.

For more insights on building AI and advanced analytics capabilities in financial institutions, members of TABInsights can now access the full report here: https://reports.tabinsights.com/leveraging-aiml-in-retail-banking

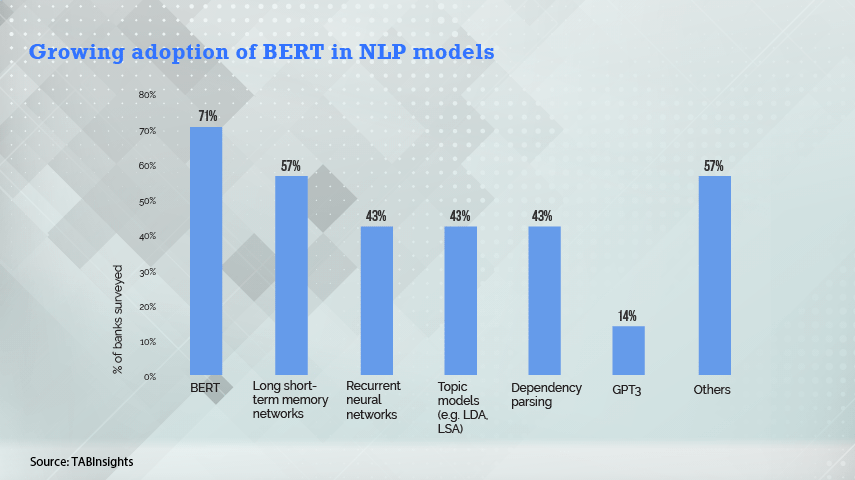

According to The Asian Banker’s survey across leading banks, a number of banks have started integrating Bidirectional Encoder Representations from Transformers (BERT) for intent detection and exploring GPT-3 Transformer models for text generation.

.webp)

.jpg)