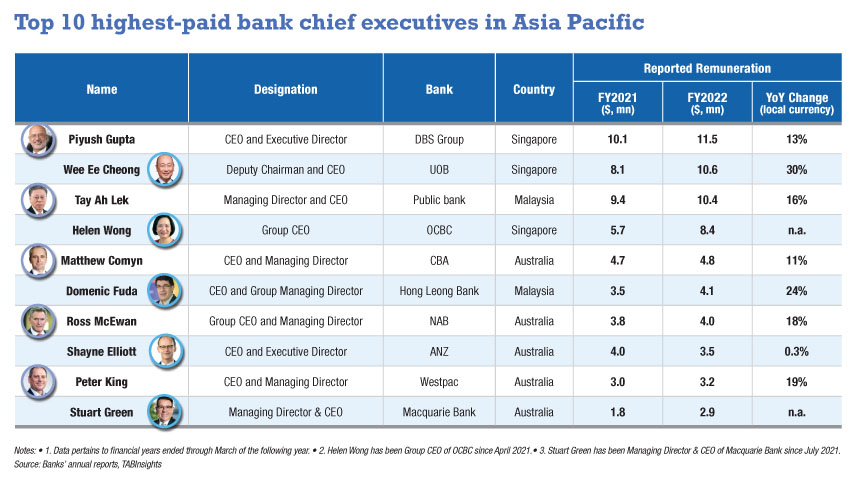

The collective total compensation for the top 10 highest-paid bank chief executive officers in Asia Pacific reached a noteworthy $63.4 million in the fiscal year (FY) 2022, marking an increase from the reported $56.5 million in FY2021. Australia led with five bank heads, followed by Singapore with three, and Malaysia with two.

DBS CEO Piyush Gupta maintained his position as the highest-paid bank chief executive in Asia Pacific. He achieved a remarkable total compensation of SGD 15.4 million ($11.5 million) in 2022. This notable figure was largely attributed to DBS’s strong performance, underscored by a 20% surge in net profit totaling SGD 8.2 billion ($6 billion) for 2022. Gupta’s remuneration saw a 13% increase, further building upon the impressive 48% rise in total remuneration he received the previous year. His base salary underwent a substantial 25% increase, reaching SGD 1.5 million ($1.1 million). Additionally, his cash bonus and shares saw respective increments of 12% and 13%, resulting in a further SGD 5.8 million ($4.3 million) and SGD 8 million ($6 million) in his pocket.

Bank chief executives received higher compensation

Among the top 10, Wee Ee Cheong, UOB’s deputy chairman and CEO, experienced the most significant increase in compensation. This excludes the heads of OCBC and Macquarie Bank, who assumed their roles in April 2021 and July 2021, respectively. In 2022, Wee’s total compensation surged by 30% to SGD 14.2 million ($10.6 million), making him the second highest-paid bank chief executive in Asia Pacific. While his salary remained unchanged at SGD 1.2 million ($0.9 million), his bonus rose by 34% to SGD 13 million ($9.7 million). His variable pay will be deferred by 60% and will vest over the next three years. Among this deferred variable pay, 40% will be provided as deferred cash, while the remaining 60% will be allocated in the form of share-linked units.

The chief executives of Hong Leong Bank, Westpac Banking Corporation, and National Australia Bank (NAB) also saw substantial increases in their total compensation.

Domenic Fuda, CEO of Hong Leong Bank, enjoyed a 24% rise in his remuneration in FY2022, following a 15% pay reduction in FY2021. In FY2022, Peter King, CEO of Westpac Banking Corporation, received AUD 5.0 million ($3.2 million) in remuneration, marking a 19% increase, with restricted share awards surging by 76% to AUD 1.5 million ($1 million). NAB CEO Ross McEwan saw his total remuneration increase by 18% to AUD 6.3 million ($4 million) in FY2022. While his cash bonus reduced by 8% to AUD 1.4 million ($0.9 million), the restricted share awards he received surged by 89% to AUD 2.4 million ($1.5 million). In contrast, Shayne Elliott, CEO of ANZ, experienced only a modest 0.3% increase in his total compensation.

CEO compensation comprised higher proportions of net profit and total personnel expenses

In FY2022, most chief executives among the top 10 observed their remuneration forming larger proportions of both net profit and total personnel expense compared to the previous year. Among them, Public Bank and Hong Leong Bank from Malaysia allocated the largest percentages of net profit and total personnel expenses for CEO compensation.

Public Bank CEO Tay Ah Lek saw his pay rise 16% to MYR 45 million ($10.4 million) in 2022. His remuneration amounted to 0.74% of Public Bank’s net profit in FY2022, marking an increase from 0.68% in the previous year. This figure exceeded the 0.55% allocated to Domenic Fuda. However, when considering the proportion of total personnel expenses, Domenic Fuda’s compensation held a greater proportion. His remuneration as a percentage of total personnel expenses rose from 1.22% in FY2021 to 1.56% in FY2022. Tay Ah Lek’s compensation as a percentage of total personnel expenses increased from 1.35% in FY2021 to 1.49% in FY2022.

Wee’s total pay accounted for 0.31% of UOB’s net profit and 0.47% of UOB’s total personnel expenses in 2022, marking the highest figures among the three Singaporean banks. Gupta’s remuneration as a percentage of net profit experienced a slight decrease, declining from 0.2% in the previous year to 0.19%. His remuneration as a percentage of total personnel expenses remained steady at 3.5%.

In contrast to their counterparts in Singapore and Malaysia, Australian banks demonstrated lower CEO remuneration as a percentage of net profit and CEO remuneration as a percentage of total personnel expenses. Among the five Australian banks, Commonwealth Bank of Australia (CBA) reported the smallest proportion of CEO compensation to net profit at 0.06%, despite CBA CEO Matthew Comyn being the highest paid among Australian banks. Westpac Banking Corporation had the lowest CEO compensation to total personnel expenses ratio at 0.09%, while NAB recorded the highest at 0.13%.

.webp)

.jpg)