Login

Enter username and password to log on:

Subscribe now

Fill in the form below to get instant access:

Already have account ? Login here

OR

Updates and Insights

In this interview, Avinash Raghvendra, president and CIO at Axis Bank shares key strategic and technology imperatives of the bank, its recent initiatives…

Taikang’s adept grasp of ultra-high-net-worth clients’ lifelong needs has enabled it to create a seamless fusion of insurance, healthcare, and asset management…

As sustainable finance grows, global governments and stakeholders employ AI and regulations to tackle greenwashing and greenhushing, promoting transparent,…

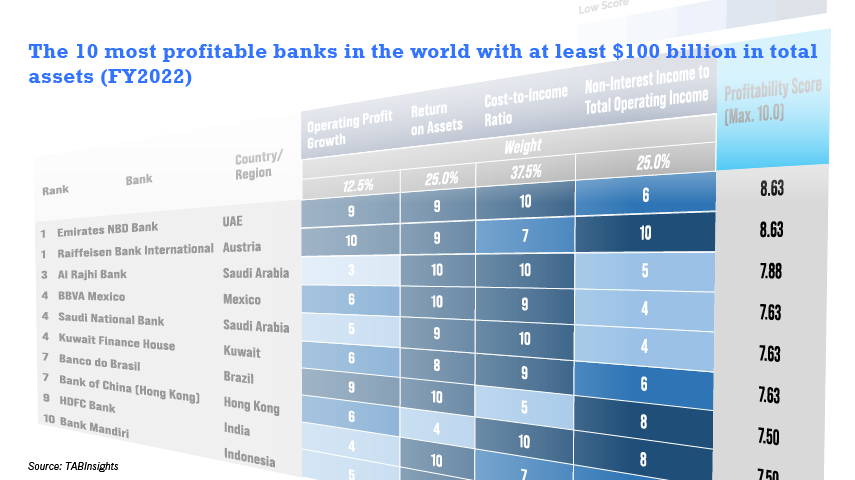

The world’s top 10 most profitable banks with assets over $100 billion include four from the Middle East, three from Asia, two from the Americas, and one…

The global use of Renminbi is influenced by geopolitics, macroeconomic conditions, infrastructure, and technology

The popularity of Bank Central Asia reflects a trend of traditional banks embracing digital innovation to meet customer preferences

Latest News And Press Releases Received

- 16 Apr 2024

- 16 Apr 2024

- 15 Apr 2024

- 15 Apr 2024

- 15 Apr 2024

- 12 Apr 2024

- 12 Apr 2024

- 12 Apr 2024

- 12 Apr 2024

News from PR Newswire

Upcoming RadioFinance

In this interview, Avinash Raghvendra, president and CIO at Axis Bank shares key strategic and technology imperatives of the bank, its recent initiatives…

AVIC Trust leads China’s dynamic family trust sector with assets over $69 billion, demonstrating innovation and expertise, and spearheading transformative…

In recent decades, China’s capital market has witnessed a dramatic transition, from a closed system to one that is inextricably linked to global finance.…

With a focus on enhancing its digital platform for affluent clients, Standard Chartered Hong Kong has affirmed its position as a leader in the wealth management…

Greg Palmer, head of strategy and host at Finovate conference series, analyses the developments in the US financial industry, highlighting how intense…

Arun Kini, managing director for payments in Asia Pacific at Finastra discussed the evolving landscape of instant payments in Asia Pacific. He highlighted…

Kai Fehr, the global head of trade and working capital at Standard Chartered Bank, discussed the recent launch of the bank's sustainable trade loan product.…

Subscribe here for updates

Subscribe to receive updates

Read the world-class contents, insights and pulse of the industry from insiders.

| | Thank you for Signing Up |

Upcoming Online Activities

We are shifting from physical conference to online event amid COVID-19. Get involved with our digital events and join the discussion!

Upcoming Events

We are actively monitoring the status of the COVID-19 outbreak and reviewing the resumption of activities in order to ensure the safety of all our attendees. We will share more information on future events in due course. We would like to thank all customers for their support.

Upcoming Events and Online Activities

-

20 - 22 May 2024

Shenzhen & Hong Kong Innovation Study Tour 2024 -

23 May 2024

The Asian Banker Summit 2024 -

21 June 2024

Future of Finance China 2024 -

18 July 2024

Finance Vietnam 2024 -

25 July 2024

Finance Thailand 2024 -

07 August 2024

Finance Philippines 2024

By continuing to browse this website, you agree to our privacy policy.