- Financial service companies see many opportunities to leverage AI

- AI delivers almost limitless potential for bank processes

- Risks abound in the use of technology

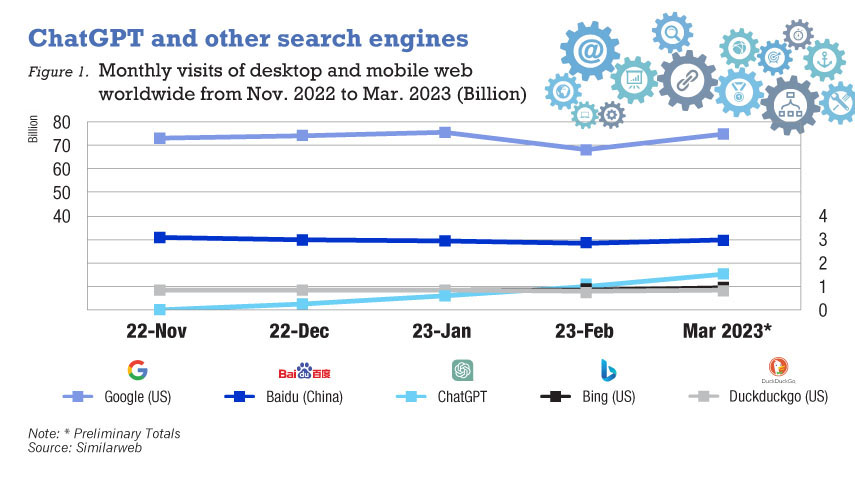

Now, more than ever, we are aware of how much we don’t know. The information revolution that has given us access to so much data has overwhelmed us at the same time. We are now confronted by the rapid rise of artificial intelligence (AI), revealed by the skyrocketing functionalities of its seminal star—ChatGPT.

ChatGPT and an avalanche of AI-powered apps and software tools have sent business and technology enthusiasts into a whirlwind. The remarkable surge in ChatGPT usage demonstrates the interest in AI applications and its potential.

Financial service companies see many opportunities to leverage AI

Established banks and financial services firms have not adopted new technologies such as machine learning (ML), advanced data analytics and cloud computing as quickly as you might expect.

This reluctance stems from a variety of factors including inherent cautiousness about new technologies. The complexity of existing IT architecture, conservative regulatory and compliance frameworks, and a lack of in-house resourcing and capability often sees banking lag other industries in the take-up of new technologies.

Lately, however, many banks and other industry players have been moving quickly. The creation of innovation departments, hubs, and centres of excellence by many financial industry players across the region and around the world cuts through many of the barriers to the rapid and more widespread adoption of new technologies.

Likewise, regulators are also looking to assist both established industry players and startups more keenly than in the past, led by the likes of the Monetary Authority of Singapore and the Hong Kong Monetary Authority.

The engagement of established financial institutions (FI) at major events such as the Singapore Fintech Festival, alongside the likes of Microsoft and Google, demonstrate both a willingness to be innovative and a tangible commitment to support innovation.

The pressure from new entrants and barriers to entry continue to drop in many segments such as consumer finance, small and medium-size enterprise finance and payments, leading to banks embracing new ways of working, and delivering products and services to customers in efficient and innovative ways.

AI is poised to play a significant part in shaping the end-to-end customer value proposition. The exact extent to which AI consumes a very large percentage of task and knowledge handling is yet to be seen.

Jason Millett, non-executive director of fintech Hay Limited and a former chief information officer believes that AI will comprise a substantial percentage and will fundamentally transform bank processes.

He said: “The application of AI for business process simplification and customer service through chatbots, as an example, is staggering. It presents an exciting opportunity for process-centric customer-focused businesses to move the dial on customer delight through smart use cases that remove friction and streamline experiences.”

The potential is almost limitless

Banks today already use AI tools to manage many banking processes. The use of AI ranges from transaction processing to market and financial data analytics to anti-money laundering and counter-terrorism financing compliance activities.

Recent advances in AI will take this to a new level with the ability to analyse data, understand and interpret instructions and take action with a higher-than-human level of accuracy across many operational activities within a bank.

According to Will Liang, executive director of MA Asset Management, and leading technology expert, the possibilities are almost limitless.

He said: “AI will redefine the landscape of financial services, pushing the boundaries of efficiency, security, and personalisation. By harnessing advanced analytics, ML, and natural language processing, AI will enable the development of innovative solutions such as hyper-personalised financial planning, real-time risk management, and autonomous trading systems.”

In addition to transforming operational functions and activities, AI is also expected to drive new product development. HSBC’s Private Banking group recently launched a structured product for Asian investors that leverage an investment platform powered by IBM’s AI engine, Watson. Investments are selected by an AI stock picker that analyses decades of investment data.

If AI lives up to its potential and there is a continued rapid development and deployment of new use cases, there is scope for a wholesale rewiring of many of front, middle, and back-office activities.

While there will be many operational risks and regulatory considerations to be addressed, the potential is apparent. There is now a far clearer path to more comprehensive automation of tasks than ever before.

Liang also highlights that the benefits of AI will also be seen in building more sustainable and resilient institutions. He noted: “AI will revolutionise credit scoring with alternative data analysis, enhance fraud detection and prevention through pattern recognition, and streamline regulatory compliance with automated reporting. This will, ultimately, forge a more resilient and inclusive global financial ecosystem.”

Risks abound

Design and implementation risks associated with AI must be addressed. Concerns by all stakeholders, including regulators and customers, need to be satisfied. Issues to be addressed will include reliability, accuracy, ethics, security and safety.

All stakeholders want assurances for data security measured and the misuse of data prevented. AI is transforming how data is stored and used. The exchange of data with third parties will also continue to be an area that is closely scrutinised by risk and compliance regulators.

Stakeholders seek assurance that AI technology yields consistent and accurate outcomes that align with community standards. Financial services firms will need to recruit a new set of resources to internally ensure that AI technology is appropriately used and sits within the appetite of the institutions.

In 2021, Goldman Sachs discovered that the credit algorithms behind its Apple-branded credit card had an inbuilt racial bias against non-white applicants. This resulted in the suspension of the cards and led to substantial losses of over $1 billion. Goldman Sachs eventually shut down its consumer finance business. If AI is not properly supervised, similar outcomes could result.

Many firms have been working at pace to address these potential risks and issues. Richard Lowe, chief data officer at UOB recently wrote that UOB has “a multi-disciplinary data ethics taskforce to develop a governing framework, policies and processes to ensure the bank uses data in a responsible and ethical manner”.

Environmental, social and governance (ESG) risks also loom large with the adoption of AI, particularly concerning the potential loss of jobs in developing countries. Many banks list the employment of workers in developing countries as a key plank of the social commitments in their ESG and sustainability strategies.

Millett shares this concern noting: “We face the risk of de-humanising our enterprises that may have short-term benefits but ultimately will impact how we work and what works for us. This is not something that should be pursued without strong controls and risk awareness of unintended consequences.”

Last month, Gordon Moore the founder of Intel who was famously remembered for coining the term Moore’s Law passed away at the age of 94. Moore's Law is the observation that the number of transistors in an integrated circuit doubles about every two years, leading to faster computer processing power. There will probably be law that measures the rapid advances in AI. There is no doubt that AI is one of the most exciting developments in recent times.

.webp)

.jpg)