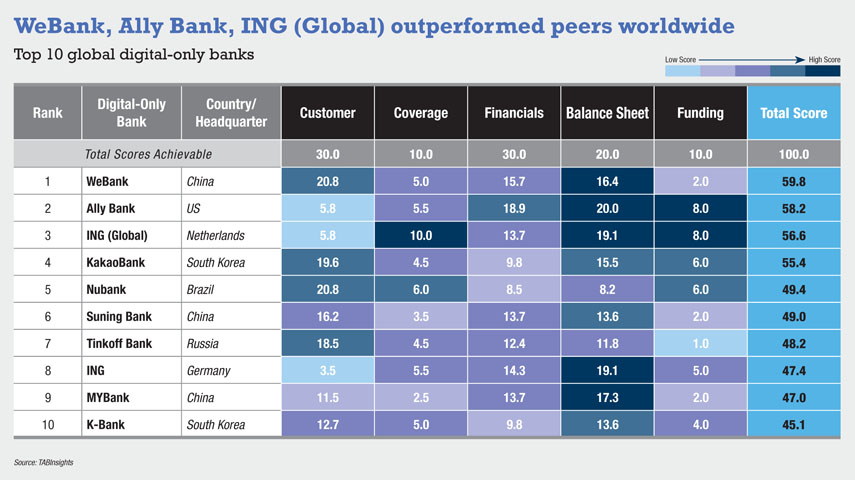

- WeBank remains top global digital-only bank, followed by Ally Bank and ING (Global) in second and third place, respectively

- Top-ranked banks by country and region include TymeBank, South Africa (Africa), Mashreq Neo (Middle East), Nubank, Brazil (South America), Allo Bank, Indonesia (Southeast Asia) and OakNorth Bank (UK)

- In the US, Ally Bank remains the top digital-only bank, followed by LendingClub Bank and Axos Bank

- Forty-seven of the top 100 digital-only banks globally are profitable

The combined total assets of the world’s top 100 digital-only banks surpassed $2.1 trillion in 2022, according to the TABInsights Annual Global Top 100 Digital-only Banks assessment, marking an increase from $2 trillion in the previous year’s assessment. Capabilities were evaluated across five key dimensions: customer, market and product coverage, profitability, asset and deposit growth, and funding.

The ranking focuses on the most successful first- and second-generation digital-only banks worldwide that operate independently of traditional commercial banks and offer a unique virtual customer experience. The evaluation process involved more than 150 leading players from 39 markets to determine the Global Top 100 Digital-only banks. These banks are spread across different regions: 41 from Asia Pacific, 38 from Europe, 10 from North America, five from South America, and three each from the Middle East and Africa.

Top-ranked banks by country and region include TymeBank of South Africa (Africa), China’s WeBank (Asia Pacific), ING (Global) in Continental Europe, Mashreq Neo of the UAE (Middle East), Ally Bank (North America), Nubank of Brazil (South America), Allo Bank of Indonesia (Southeast Asia) and OakNorth Bank (UK).

WeBank, Ally Bank and ING (Global) are the top three digital-only banks in the annual Global Digital Bank ranking

WeBank maintained its position with the largest user base and robust financial performance. Its user base has surpassed 362 million individual customers and 3.4 million small businesses. In 2022 alone, the bank experienced monthly growth of 2.5 million customers. Additionally, it maintains one of the highest users-per-staff ratios, with an average of approximately 122,000 customers per employee. WeBank has consistently refined its fully-distributed core system architecture, enabling it to handle a daily transaction volume exceeding 840 million transactions.

WeBank’s return on equity (ROE) was the highest among the top 100 digital-only banks. It achieved an impressive ROE of 32%, calculating by dividing the profit before tax by the average equity. By comparison, ING (Global) reported lower ROE of 20%, and Ally Bank 26%. WeBank also reduced its cost-to-income ratio from 35% in 2021 to 31% in 2022, outperforming most digital-only banks in the ranking. However, its average revenue per user remained relatively low, marginally increasing from RMB 83 ($12.9) per user in 2021 to RMB 97 ($14.4) in 2022.

Ally Bank and ING (Global), both first-generation digital-only banks, ranked second and third. Ally Bank showcased stronger financial performance, while ING (Global) outperformed Ally Bank in terms of market coverage. ING (Global) served approximately 37.5 million customers across 10 markets and held the highest total assets among digital-only banks as of 2022. However, it has one of the lowest users-per-staff ratios among the top 100 digital-only banks, at 860. On the other hand, Ally Bank, the largest all-digital direct bank in the US with total assets of $182 billion, experienced an increase in average revenue per customer from $830 in 2021 to $893 in 2022, surpassing the average of $176 for the top 10 digital-only banks.

KakaoBank and Nubank both advanced in the rankings

KakaoBank has climbed up the rankings, securing the fourth position in the world and ranking second in Asia Pacific. In 2022, KakaoBank recorded a 14% increase in customers, setting a record of 20.4 million. This equates to an average monthly increase of 0.4% of the total population in South Korea. The bank’s revenue surged by 45%, primarily driven by a 52% rise in net interest income, attributable to interest rate hikes and the launch of new products. Its deposits rose by 10% to $26 billion at the end of 2022, with low-cost deposits constituting 61% of the total. Additionally, its loans went up by 6% to $22 billion. KakaoBank will diversify its loan portfolio into broader areas and it is anticipating a growth of around 10% in its loan portfolio in 2023.

Nubank leapfrogged to fifth from 10th position in the previous year’s ranking, and it holds the top position in the South America. Its user base surged to 74.6 million by the end of 2022, a 38% increase from the previous year’s 53.9 million. In addition, it witnessed a further increase in user engagement, with the ratio of monthly active users increasing to 82% in 2022 from 76% in 2021. It broadened its scope of financial products and services to encompass insurance and investment offerings. In 2022, Nubank’s total assets increased by 51% to $30 billion, and its deposits grew by 64% to $16 billion. Additionally, Nubank’s total revenue surged by 144% and it achieved breakeven in the third quarter of the year, generating a profit before tax of $5.1 million.

OakNorth Bank emerges as the top digital bank in the UK, while Mashreq Neo and TymeBank remain the top in the Middle East and Africa, respectively

OakNorth Bank has surpassed Wise to become the top digital-only bank in the UK; it holds the fifth position in Europe. Wise and Revolut secured the second and third positions in the UK, respectively. OakNorth Bank outperformed in financial performance and balance sheet, while Wise and Revolut excelled in terms of customer and market and product coverage. OakNorth Bank achieved robust profitability, with a ROE of 22%, a cost-to-income ratio of 29%, and an impressive revenue per user of $1,278.

Mashreq Neo of the UAE has retained its position as the top digital-only bank in the Middle East, followed by UAE’s Liv and Bahrain’s ila. Similarly, in Africa, South Africa’s TymeBank has remained the leading digital-only bank, with Carbon and Kuda from Nigeria following closely behind. Digital banks such as meem and Hala from Saudi Arabia, and Discovery Bank and Bank Zero from South Africa did not make it into the top 100 this year.

Forty-eight of the top 100 digital-only banks globally are profitable

The combined annual gross revenue of the top 100 digital-only banks reached approximately $66 billion in 2022. Despite a 1% decline in revenue for ING (Global), the largest revenue-generating digital-only bank in the ranking, these banks experienced an average growth of around 16% in their aggregate gross revenue. On average, they offered 6.2 top-line products up by 5.4 from 2022. Notably, the 10 largest revenue-generating digital-only banks contributed to 67% of the total revenue, highlighting the comparatively modest revenue generated by most digital-only banks.

The number of profitable digital-only banks in the Global Top 100 increased to 47, compared to 29 in the previous year’s ranking. Some digital banks achieved profitability in 2022, including Judo Bank from Australia, Airtel Payments Bank from India and Starling Bank and Revolut from the UK. Meanwhile, the increase is partially attributed to the inclusion of new banks in the ranking, such as Allo Bank from Indonesia and LendingClub Bank andAxos Bank from the US. Allo Bank is the top digital-only bank in Southeast Asia, with an ROE of 9%, the highest in the region. LendingClub Bank and Axos Bank ranked second and third in the US with ROE of 22% and 24%, respectively.

Profitable banks displayed an average ROE of 13%. Digital banks specialising in personal finance, wealth management, and small and medium-sized enterprise banking emerged as the most profitable. Among the most profitable digital-only banks, Asia Pacific led with 48%, followed by Europe with 31%, North America with 15%, and the Middle East and Africa with 6%.

A growing number of digital-only banks, such as Nubank from Brazil, bunq from the Netherlands, UnionDigital Bank from the Philippines, as well as Zopa Bank and Allica Bank from the UK, are expected to attain profitability in 2023 and 2024.

To view the full Digital-only Banks Ranking visit : https://www.tabinsights.com/best-digital-bank-rankings/global-digital-bank-rankings.

.webp)

.jpg)